Will the Fed hint at a pause with regards to future rate cuts?

Another 25 bps rate cut today is definitely in the bag for the Fed but the real question now is whether or not there will be any more to follow in this supposed adjustment/cycle or whatever you want to call it.

The issue for the Fed is that the state of the US economy doesn't warrant protracted rate cuts and with US and China reaching a ceasefire in the trade war, it is helping to slow down the ticking time bomb strapped to the global economy.

However, it's not to say that the US economy haven't been showing signs of weakness - because it certainly has.

Despite the Trump administration's efforts in talking up the economy, recent data suggests it isn't exactly booming but it's not showing a rapid pace of deterioration either.

As such, it leaves the Fed in a bit of a tough spot.

It took them three years (even longer if you include the tapering) to lift rates off zero to get them to 2.25% - 2.50% at the end of last year and in the span of three months, we're resetting the clock back to March 2018.

With each rate cut, it's getting tougher for the Fed to argue for the next one considering that the US economy isn't free-falling or anything.

But given the performance of the dollar (threat to inflation) and pressure from Trump, they can't afford to outright say that they will be shelving rate cuts from hereon either.

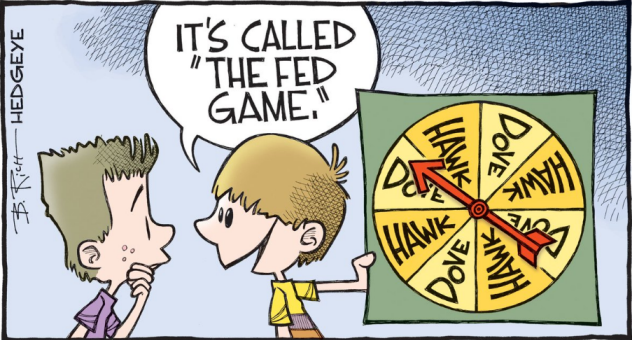

Given that predicament, I would expect the Fed to continue doing what it always does. That is to point the finger towards the data.

They will allude to being data dependent again and continue to make mention of taking a decision meeting by meeting. However, the issue with that is once again, they risk getting bullied by the market down the road eventually.