Today is not a day for trying to pick a top in oil

We're in 'golden hour' in terms of whether the OPEC non-OPEC oil deal will be extended, and with heavy weights, Russia and the Saudi's backing a 9 month extension, it's little wonder there's a lot of green on the Brent chart.

If there's one thing I've learnt about trading oil is that it can be a fantastic technical market when things are calm and collected. It's when things are not, that you can get taken to the cleaners if you're the wrong side of a move.

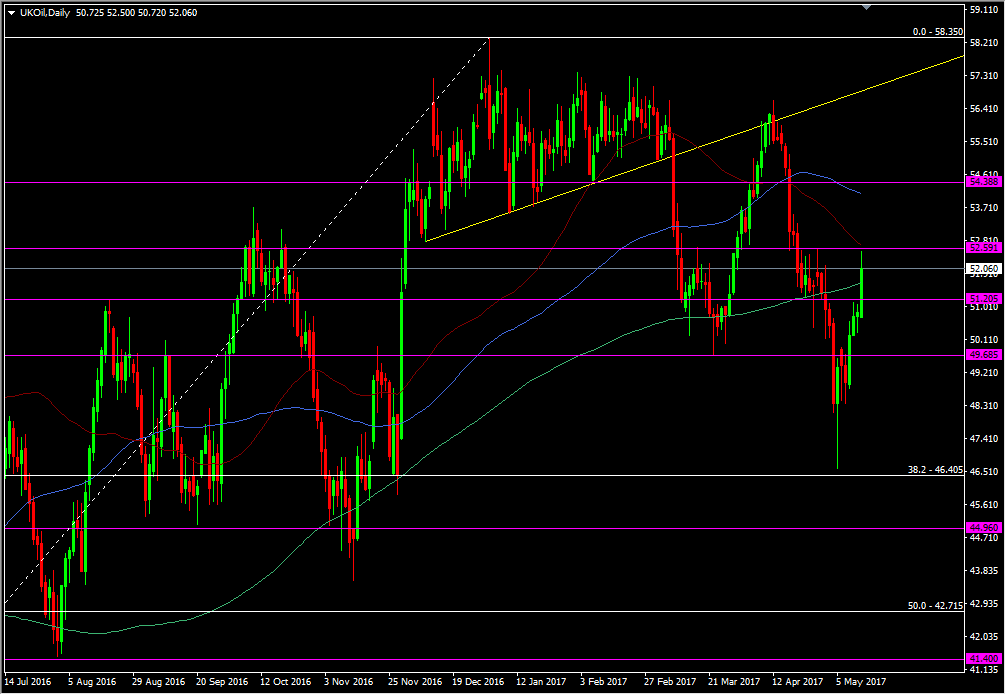

Brent daily.

As you'll see from the chart, there are levels that look minor but have stopped the price and developed into something more substantial, only to be blown when there's big news. In such high news risk scenarios as now, it pays to not to rely on these minor or shorter-term levels too much but instead, pick your bigger battlegrounds.

For me, the late 2016/early 2017 highs is one area worth keeping an eye on. That area 56.60/57.40 is probably the most important on the chart now. That marked the top following the oil deal, and it could do so again if any new deal doesn't blow our minds. At the moment, a 9 month extension puts it nearer the top of market expectations but keeping the cut limit takes some of the shine off of it.

If that's the final outcome then oil traders might be sorely disappointed and we could get a sharp sell off. If any new deal is longer than 9 months, and/or includes extra production cuts, that should be enough to push oil higher. Be warned though, the first deal didn't take the price higher after it became official so it's doubtful any tacked on extension will do either, unless its a blockbuster.

For now, expect to carry on hearing from every Tom, Dick and Harry oil producer, and the price to wobble about on those comments as we head closer to the OPEC/Non-OPEC discussions.