Heavy retail interest in oil is messing with the market

I've been warning about this.

The OPEC-driven interest in oil markets sparked a wave of speculation and now it's becoming clear what's happened.

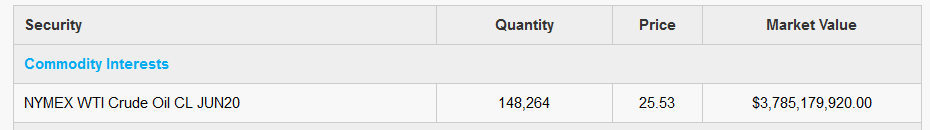

Evidently, retail traders have ploughed money into USO, which is the plain short-term long-oil ETF. The problem, is that 27% of the open interest in the June oil contract is owned by USO.

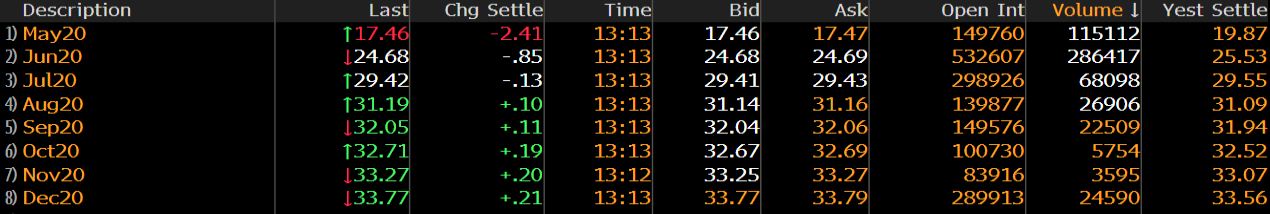

(total open interest is currently 532,607 contracts)

For some perspective, there are usually around 120 million shares of USO outstanding. That's risen to nearly 900 million.

What happened -- I think -- is that retail traders saw front-month oil at $20 and futures a few months out at $35 and thought they could ride USO. But it doesn't work like that, the roll is devastating.

USO has now realized it has a big problem. It announced overnight that it will move 20% of the open interest of the ETF to the July contract, starting today.

"As a result of these changes, USO may not be able to meet its investment objective," according to the filing.

It seems to me that the trade here is to short USO or the June contract because around one third (when you add the other ETFs) of the market will need to sell in three weeks.

In any case, watch out for some panic in the crude oil market today as confusion reigns.