Equities stay on the defensive even as bonds are seen calmer so far today

European equities are keeping lower with the DAX down 0.8%, with US futures also hinting at softer tones following yesterday's selloff.

Dip buyers were a little interested at the tail-end of Asian trading but the mood has turned since with S&P 500 futures seen down 0.4%, Nasdaq futures down 0.6%, Dow futures down 0.4%, and Russell 2000 futures down 0.8% currently.

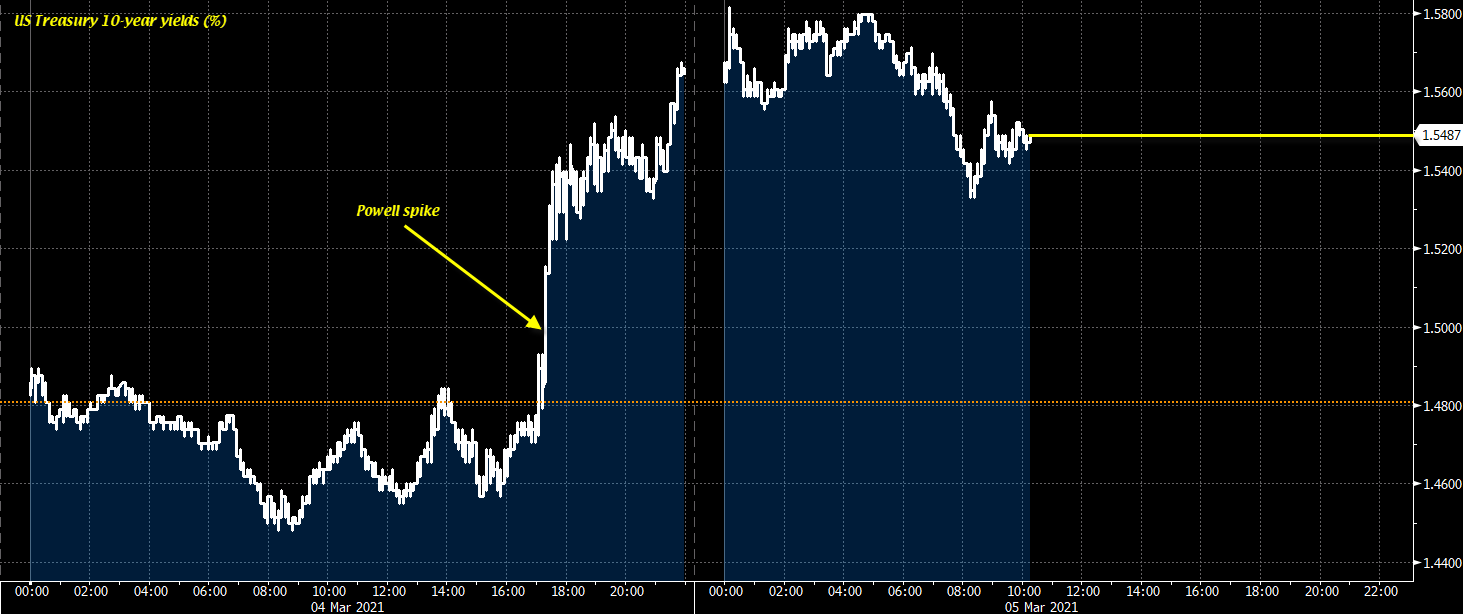

10-year Treasury yields are keeping calmer, sitting a little lower on the day just below 1.55%. However, there's little doubt that sentiment remains fragile at this stage.

As much as other central banks are stepping up their game in quelling the bond market rout, the Fed is leading the charge on the other side and that is tough to ignore.

It is truly gut check time for equities ahead of the weekend with the S&P 500 breaching key trendline support and eyeing its 100-day moving average:

Meanwhile, the Nasdaq has broken a similar trendline support and is testing its own 100-day moving average upon the drop yesterday:

And the Dow is on the verge of testing its own key trendline support with the 100-day moving average seen just below that as well: