Gold hits an all-time high, silver is surging, the dollar is sinking across the board, and Bitcoin is back above $10,000

There's plenty of buzz in the market to start the week, even if equities' movement may be less suggestive for the time being. That said, US futures are sitting up by ~0.6% and that could whet Wall Street's appetite for a stronger push later in the day.

Meanwhile, the bond market continues to send ominous signals with 10-year Treasury yields hovering close to the lower bound of its recent range near 0.54% to 0.56%.

The new week is already seeing plenty of action but things are just warming up:

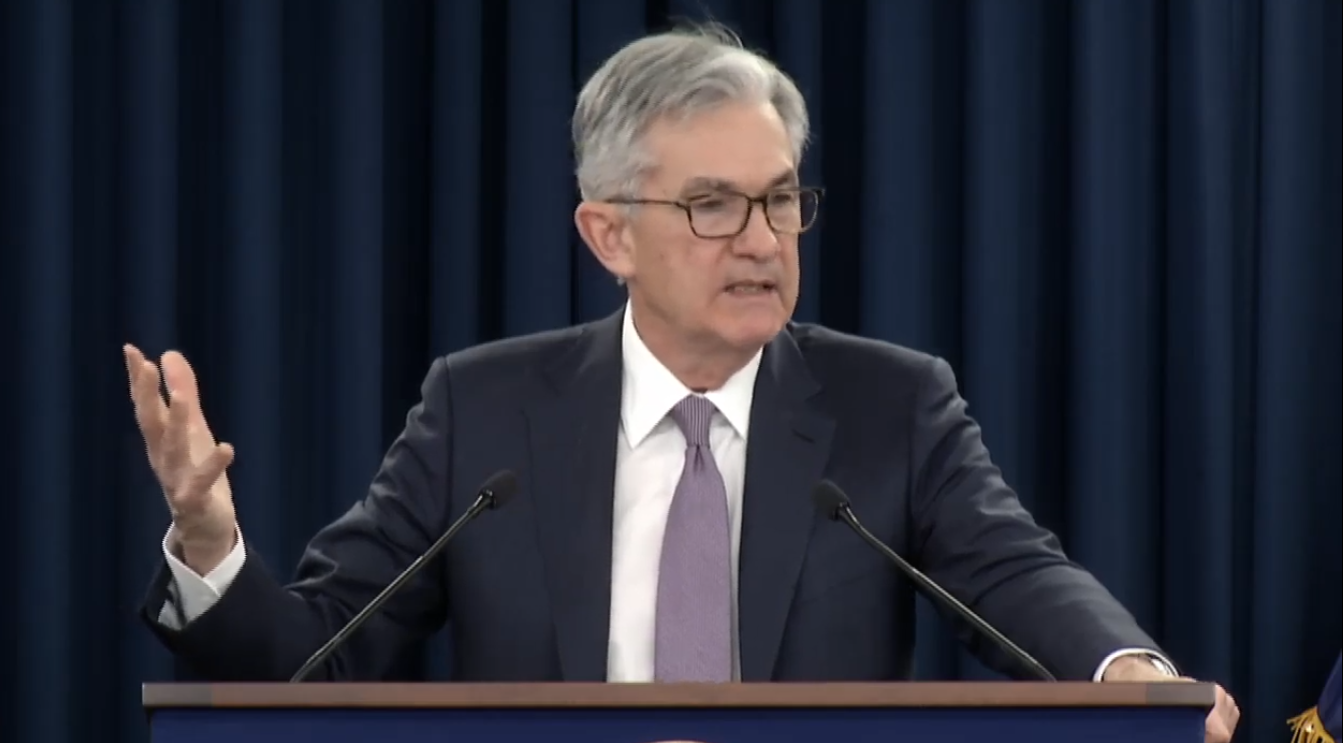

FOMC meeting

The Fed is meeting this week but it could very well end up being a non-event, as what market participants are expecting. Powell & co. have done their part to keep the stimulus tap flowing and they should likely reiterate a similar stance later in the week.

It will pretty much be viewed as an event to reassure markets that they will continue to keep stimulus measures in place to ensure the economic recovery.

US-China geopolitical tensions

The situation between the two is still a key issue to be mindful about after the whole "consulates are the new tariffs" debacle last week.

But as long as the facade of the Phase One trade deal remains firmly in place, it is tough to imagine any spat here leading to extensive market moves.

US stimulus proposals being sorted out

Senate GOP lawmakers will be unveiling their coronavirus relief plans to start the week, and that will be a key thing to watch as to how quickly they can wrap up all of these proposals and turn them into concrete relief measures for the economy.

This could arguably be the biggest topic to keep an eye out for as market participants have definitely come to learn how much the economy has relied on the stimulus measures set out by the government. So, watching what comes next will be a key focus.

US unemployment benefits set to expire

The first nudge off the fiscal cliff will begin this week on 31 July where the $600 per week in unemployment benefits will formally expire.

Given the fact that Congress will only start unveiling proposals this week as pointed out above, it all but assures that there is no extension or any immediate replacement to these benefits for now. And that could present a big problem.

With millions of Americans already suffering from joblessness, the lack of unemployment benefits could be what topples the house of cards - especially should lawmakers fail to come up with anything in the next few weeks to tackle the issue.

US Q2 GDP figures set to be released

We all know the global economy will experience its biggest ever contraction in Q2 this year so the extremely negative figure here (estimate of -35% q/q) should not surprise the market, though the details will be something to take note of in any case.

Key earnings releases

Yep, it is still earnings season and they don't come any bigger than this week with Facebook (Wednesday), Apple (Thursday), Amazon (Thursday), and Alphabet (Thursday) all set to report earnings later in the week.

Although the market has largely braved through earnings season without much of a hitch, key tech earnings could be an entirely different story so let's see if that could help drive some impetus in trading sentiment ahead of the month end.