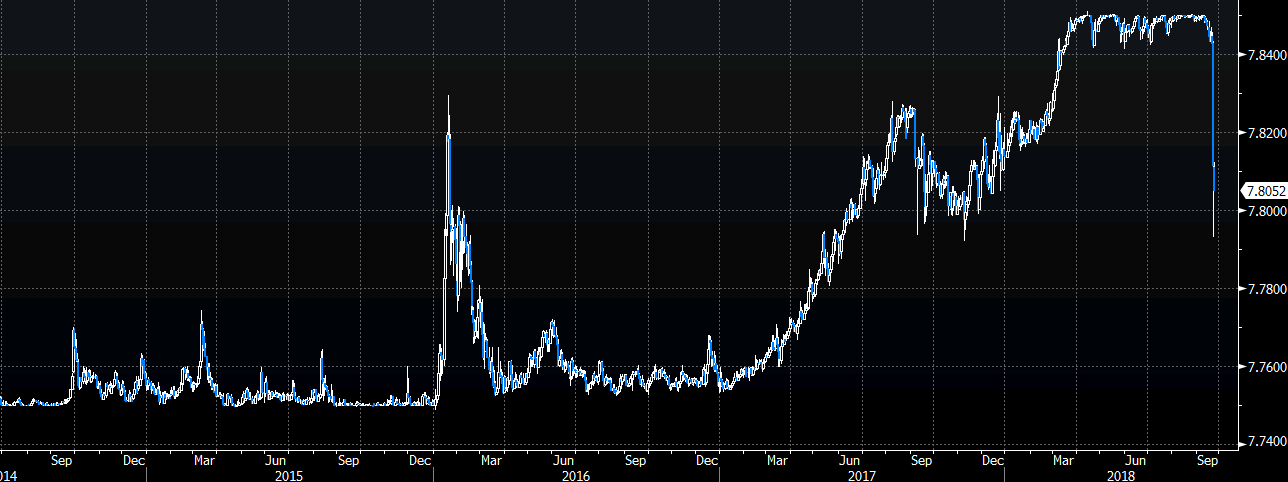

The HKD jumped on Friday. I mentioned it but didn't post anything on the explanation

I have just been asked in the comments on it, so sticking this up now. At the time I heard a combination of factors, all of which seem plausible (stronger yuan and a promise from China not to weaken it, a squeeze on HKD shorts, resolute HKMA, and rising HKD short funding costs)

But, the jump was the biggest for the currency in 15 years …. a historic move.

The lead up had been a weakening in the HKD to test its band over recent weeks (and months). The HKD is pegged to the USD and as the Fed raised rates it made the USD more attractive, relative to the HKD. There were A LOT (srsly, huge) shorts in the HKD looking for the peg to 'break'. The HKMA (Hong Kong Monetary Authority, Hong Kong's currency board and 'central bank') have held the peg in place for the past 20 years, so the trend was not on the side of the shorts. HKMA are not given to caving in (lookin' at you T. Jordan).

On Friday, the factors I mentioned above all came into play. Also in the mix:

- China said to be planning an issuance of debt in Hong Kong

- Buying driven by stops (always a factor in big moves though)

- A potential rate rise coming in HK ( Hong Kong banks' 'prime rate' has not risen since 2006)