Looking around the prices today you’d think that all is well with the world.

Right now it looks like a good old fashioned flush out rather than anything bigger but it’s still early days yet. It looks like we’re going to limp out of the week with a healthy bounce in stocks and US bond yields and that may keep the wolves from the door for a while. It’s not looking so hot for the month so far though

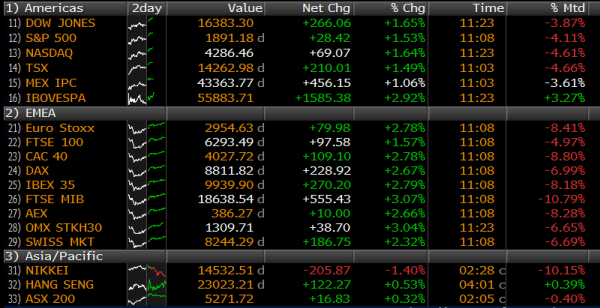

Stocks month to date

17 days into the month and that doesn’t make for healthy reading.

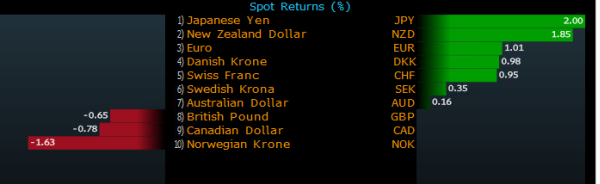

Currencies for the month so far have seen the Yen, Kiwi and Euro making a comeback against the dollar

Currencies month to date

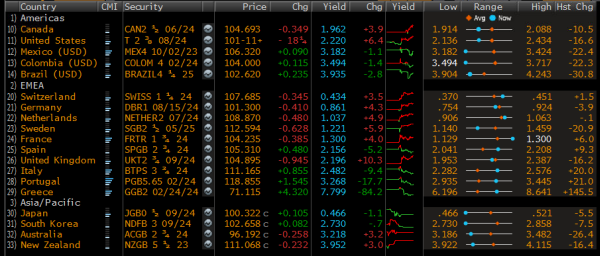

And how about those bonds eh?

Bond yields month to date (final column)

It’s probably bonds we will have to keep an eye on over the next few weeks. Currencies have joined in the party but it’s been bonds that has had most of the action. Changes in flows often happen over a sustained period of time and we could have just seen the start of a shift in sentiment between Europe and the US. On paper the US is in much better shape than Europe and the market is starting to really trade that way. Throw in the end of QE, arguments on rate hikes, expected slowdowns in major economies and there’s plenty in the mix to get investors worried and searching for safety and yield.

It’s been a fun week and we should remain cautious for next week. This is one of those times where the market tectonic plates have shifted and we may get plenty of aftershocks. Whatever happens it sure beats those summer months of non-activity. I hope you’ve all come out winners or at least undamaged.