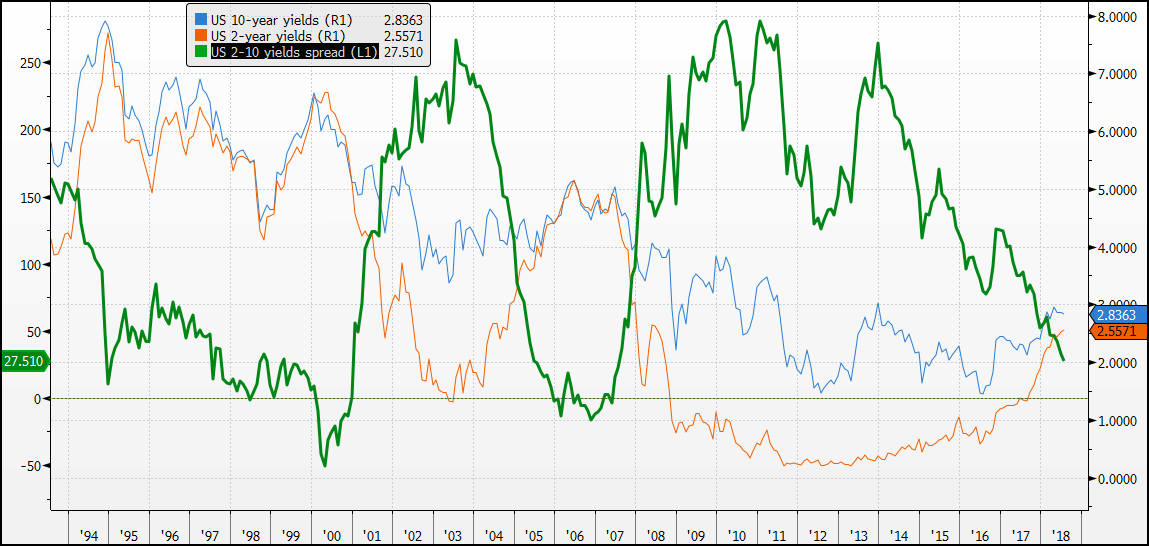

The 2s-10s spread continues to narrow further, down to 27 bps

There are two things that have been giving added support for a flatter yield curve so far this year, one is the Fed continuing to tighten and the second being the trade tensions.

The closer we are to a flat or an inverted yield curve, it strokes the R-word on every one's lips.

Historically, the last two times we saw an inverted yield curve (2s-10s spread below 0) there was a recession to follow thereafter in March 2001 and December 2007.

Whether or not this time around is a different case is still up for debate and in the end, the people who are right will only be known after the fact. But regardless, it will still prompt worries in the market and may cause a rethink in the Fed's tightening cycle.

This could all be blown over proportion, but it is something to keep an eye on because in essence, this could be a self-fulfilling prophecy.