UK February inflation data now out 20 March

- -0.5% prev

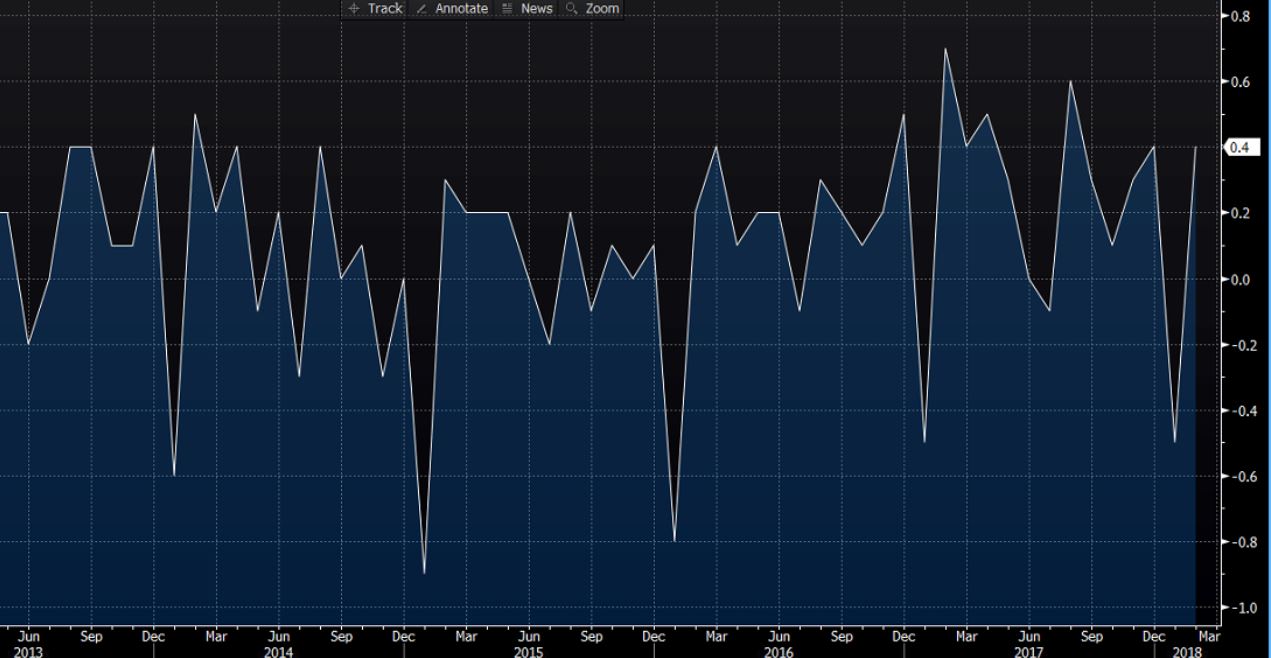

- yy 2.7% vs 2.8% exp vs 3.0% prev

- Core CPI yy 2.4% vs 2.5% exp vs 2.7% prev

- CPIH yy 2.5% vs 2.6% exp vs 2.7% prev

- Retail price index 278.1 vs 278.2 exp vs 276.0 prev

- RPI mm 0.8% as exp/prev

- yy 3.6% vs 3.7% exp vs 4.0% prev

- RPI ex mortg interest pymnts 3.6% as exp vs 4.0% prev

- HPI yy 4.9% vs 5.0% exp vs 5.0% prev revised down from 5.2%

Says the ONS:

- The largest downward contributions to the change in the rate came from transport and food prices, which rose by less than a year ago.

Falling prices for accommodation services also had a downward effect.

Rising prices for footwear produced the largest, partially offsetting, upward contribution.

Full report here

Softer headlines should be no real surprise as per my preview. Lessens the need for a rate hike but a peak up around 3% was in the BOE f/c anyhow.

Algos take GBPUSD down to 1.4017 but the demand around 1.4020 that I highlighted in the order board post is holding further falls and now 1.4040 again. EURGBP 0.8784 after a run up to test 0.8800

I hope you were poised with your entry/exit levels as I always advise in previews of key data events.