US dollar shakes off retail sales data

I often say that the strongest signal of all in the market is when something won't fall on bad news, or won't rise on good news.

The retail sales report and PPI were US dollar negative but after a blip, the buck has stormed back. EUR/USD is down to 1.0735 after rising to 1.0795 after the data. It's a similar story across the board as the US dollar quickly shook of the bad news.

Or were retail sales better than they appeared?

Another factor might be the details of the retail sales report.

The market was focused on the latest data but it looks like there were some revisions from the mid-year data. The June report now shows a nearly 3.5% monthly rise in the control group. That paints a much better overall picture of the US consumer than previously.

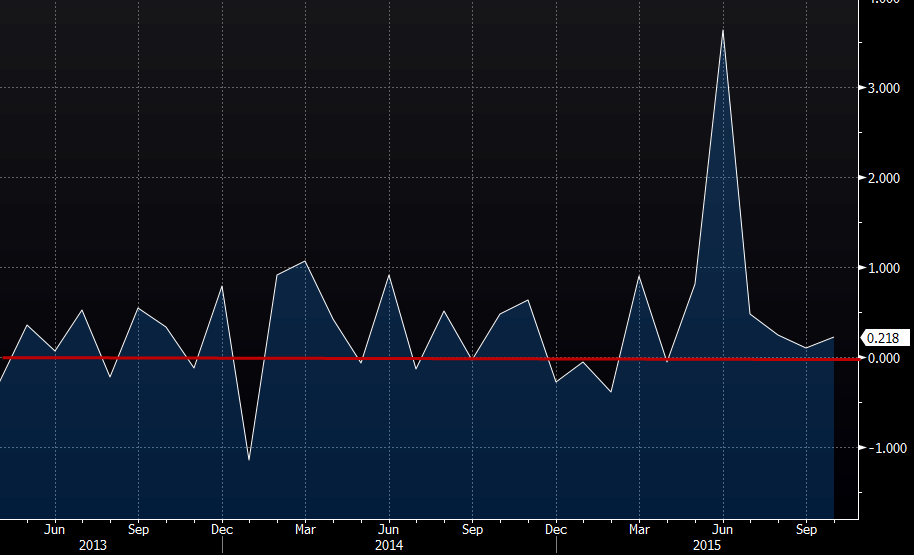

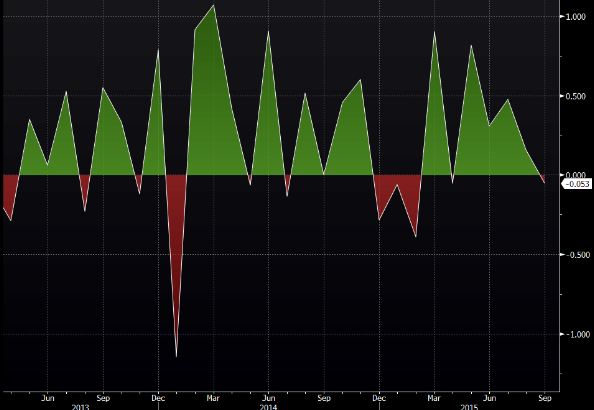

Below is a snapshot of the series before the latest data.

They're the same up until May but after that there are some big changes. No one is reporting on it now and I'm pulling that from Bloomberg data. I've been trying to access the raw data at the Commerce Dept site but their Excel tables are broken at the moment.