Stocks were buoyant on Monday but USD/JPY is often a better metric of overall market sentiment and the pair hardly moved in US trading.

If anything, USD/JPY edged lower, despite the S&P 500 rallying nearly 1%. The bond market also remained cautious and that says the excitement in equities might be short-lived.

I get the sense that fear of missing out and all the talk of a bottom in stocks on the weekend sparked much of the buying in US stocks while yen and bond traders want to see what the Fed does at the end of the month before making bets. The VIX was down a whopping 15% in the session to 18.67 — down from as high as 31 last week.

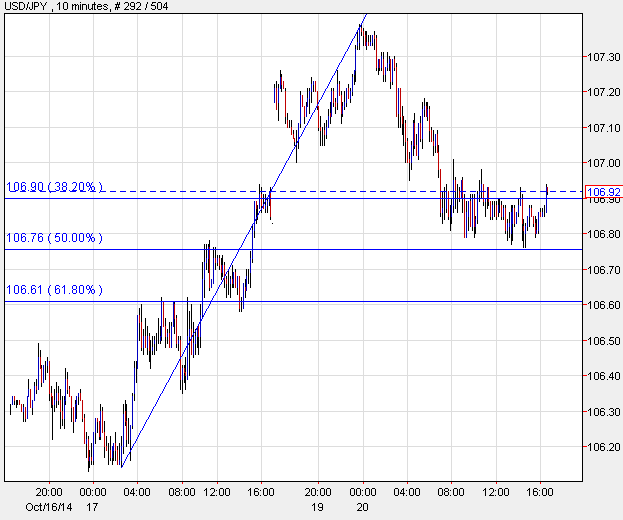

This might be one of the times for swing trading strategies and catch a break from the 106.75 to 107.00 range in US trading.

A break of 107.00 points to a quick move back to the Asia-Pacific high of 107.39 while a break of the 106.76 points to a quick move to 106.61 and potentially a move to Friday’s interim high of 106.15.

USDJPY intraday chart

The US economic calendar is light for the remainder of the week so traders will be looking to the slate of Chinese data due in the hours ahead. Earnings are also a key component. The market is churning around on Apple earnings but several others, including Cola-Cola tomorrow will be important for overall sentiment.