Is the RBA statement a game changer that many think it is?

Those devilish cads downunder at the RBA have been flexing their jaw muscles in new ways today

The change in language has been jumped upon as meaning that they've taken the foot off the pedal in commenting about the level of the aussie dollar

As someone who has had the benefit of catching up with the news after the event, and thus having time to ponder it rather than react immediately, I'm not sure that this is a game changer

Ok, they've dropped the sentiment that further depreciation is necessary and likely but saying the aussie dollar is adjusting doesn't mean the trend is over. For one the "adjustment" that's been happening for the last 3-4 years looks far from over, two there's still plenty of fuel in the USD side of the trade

Reader Credit Phil summed up part of it pretty succinctly;

"Game changer for the economy, that remains to be seen. Commodities unlikely to head higher anytime soon, and mining likely to start directly contributing to unemployment likely to kick in soon (as opposed to not contributing to employment right now)"

So why the change in sentiment?

We've all heard the saying, "be careful what you wish for". Well, Steven's & Co may be waking up to the fact that they are getting exactly that. They've been wanting the aussie to drop for years and they've got their wish. One thing they haven't got is control over the move. As far as I'm concerned there's still a very bearish view on Australia and that's not going to let up any time soon, particularly as that's a big external view also. The RBA can do whatever they want to help Australia domestically. What they are powerless to do is stop China's economy from weakening, global growth from weakening, commodity prices from falling and USD from rising, to name a few

We're a long long way from seeing a turnaround in most of the above and that adds up to further and possibly a larger continuation of the down trend, and that's what may be scaring Steven's. A falling AUD is fine, a collapsing AUD isn't

Again, I've got to highlight our astute readers and Andrew Cole also sums it up perfectly;

"It was inevitable, too low AUD will hurt on imports such as fuel...approaching 0.70 he had to throw out the anchor"

This is exactly what I believe Steven's may be doing. The comment;

"The Australian dollar is adjusting to the significant declines in key commodity prices."

doesn't scream "this is the bottom for AUD and we're happy with the level now", it says that the RBA have thrown out the parachute because they see real trouble for AUD

In essence the RBA may have to go against their own rhetoric and fundamental view if they believe that the currency (or the economy from the result of it) is in trouble. It's always a dangerous game talking about a currency and the RBA are in the thick of it. They've now got to counter a possible downside acceleration in an environment where their likely monetary policy moves add to that move. Who'd be a central banker eh?

What does it mean for AUD?

The price today tells the story, the market has bought this statement shift as a bullish sign for the currency. I highlighted 0.7350 as an important point for the trend and it's been taken out on this move. The next few sessions will be important but we still have a long way to go before the shorts even remotely start to think about throwing in the towel

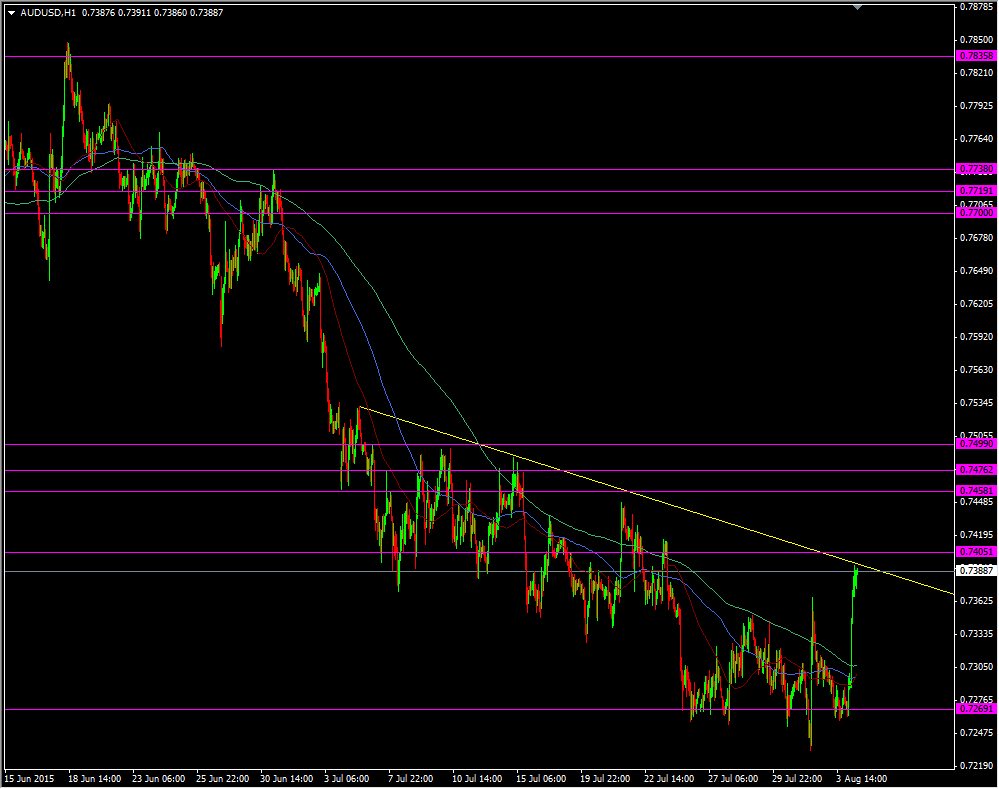

AUDUSD H1 chart

Near term we're up against the down trend from June. If this move has legs, and the market is really taking Steven's comments as a change of heart, then this level should go pretty easily. If it doesn't then that tells us what the market really thinks

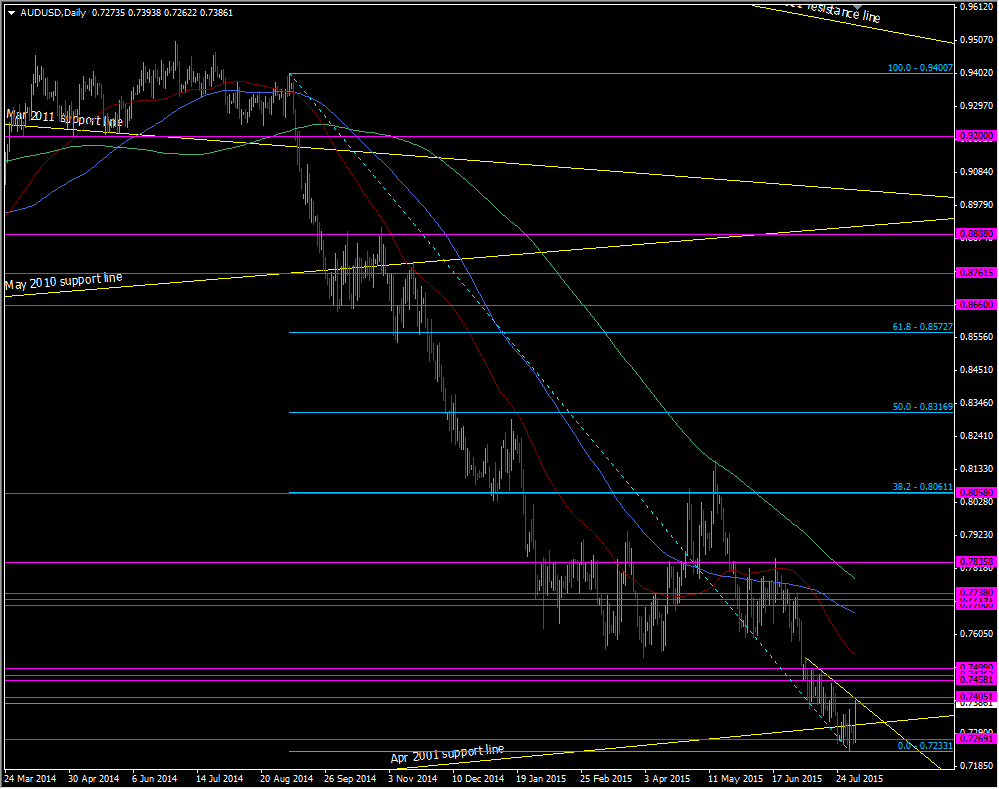

Looking further out we can see the levels that shorts would start to question an upward move and that would be around the 38.2-50.0 fib levels from the 2014 highs

AUDUSD daily chart

That's from 0.8060 to 0.8317 and still miles away. Looking even further out on the weekly chart, the 38.2 fib from the 2011 drop is at 0.87. That shows you the scale and size of the trend and highlights how much of a move the currency has to make to even get close to thinking about a proper turnaround

At the moment I'm flat as I had a stop just above 0.7360 on the rest of my position. It was a stop put in place just for this type of event (something that comes out of nowhere while I'm counting sheep). The tech levels above still look good to me so I'm going to look to re-establish shorts. I might look at the 0.7400 level and this downtrend line but it might be too soon to see this move fade, so if I do it will be a small trade. Up towards 0.7500 would be my preferred target

Maybe too much is being made of the comments. Maybe they're being misinterpreted. Whatever my thoughts are, I'm always guided by the price. If the price moves up through the levels then I reassess my strategy and decide whether I'm faced with a brick wall or a good opportunity to short it again