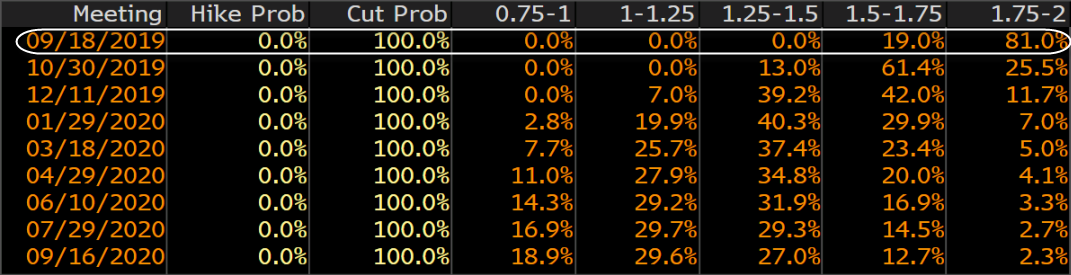

A rate cut by the Fed next month is still 100% priced in

The only shift in expectations is that Fed funds futures scaled back on the 50 bps rate cut odds, falling to 19% now from 31% at the start of the week. That helped the dollar to gain some reprieve overnight but it hardly reflects a major change in sentiment towards the Fed.

At this point, you have to wonder whether or not markets are getting too ahead of themselves in pricing in such a move.

With US and China hitting the brakes on any potential further escalation in the short-term, is there any viable reason for the Fed to pursue further rate cuts for the moment?

I mean, don't get me wrong. In my view, the US-China trade rhetoric hasn't changed significantly whatsoever but at least there is some hope that things won't get worse over the next few weeks.

Meanwhile, the global economic outlook does look bleak but domestic conditions are still holding up decently. Unless the Fed has a premonition for an imminent recession - looking at 2s-10s - then it's startling to think they would so easily throw away 2/9 rate hikes over the past three years (four if you want to include the taper tantrum).

Next week's Jackson Hole symposium is going to be a big one. If the Fed isn't leaning towards a rate cut next month, expect them to send signals to market participants as such. In reaction, we could see a major U-turn in market pricing and Treasuries particularly.

That will be a key short-term risk for yen bulls despite global risk appetite continuing to stay weaker in the big picture.