It's 76 days until the election

The deadlock in US economic stimulus negotiations highlights the political risk for the US coming out of the election. The sides simply can't compromise.

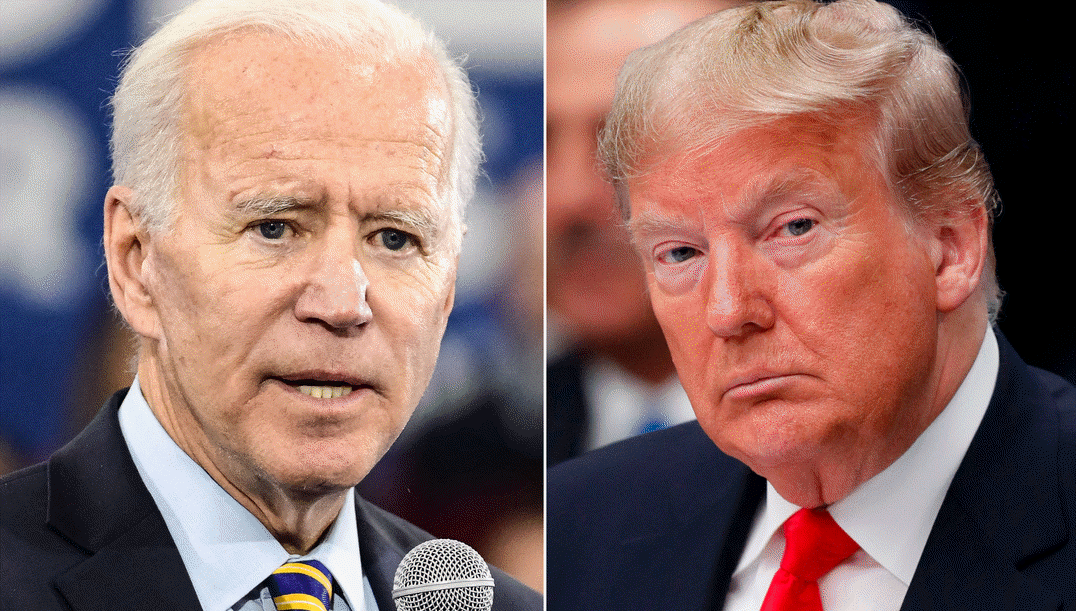

At this point, you have to assume that most Americas have made up their minds about Trump, Biden and how they will vote.

In normal times, a Biden win would be the consensus. National polls in the past week show him from +4 to +11. Of course, these aren't normal times and no one has forgotten the surprise on election night in 2016. Even with that, it's worth remembering that Clinton won the popular vote by about what was expected, it was that a handful of states surprised. Her polling average was also only about +3% and she never reached this kind of spread.

Here's how BMO sees it:

We're struggling to gauge the extent to which a Biden/Harris victory is priced into financial markets. Conventional wisdom suggests that given the wide lead the Democrats enjoy in the polls, a blue sweep in November is consensus at this stage. Alas, the experience of 2016 has fundamentally changed the way in which investors view the accuracy and therefore relevance of the polls - recall Brexit and Trump. This highlights another way in which the market is effectively 'flying blind' - one enduring theme of 2020 to be sure. It also presents an opportunity for the further refinement of election outcome expectations to be incorporated into market pricing. For example, if mid-October arrives and the consensus around a Democrat victory is finally cemented; the kneejerk response would intuitively be downward pressure on risk assets given a less pro-business stance - to say nothing of the prospects for rolling back the GOP's tax cuts.

I can get behind the idea that a Biden victory is priced in. For me, the tougher question is the Senate. If Democrats fail to control it, then the next two years will offer few opportunities for change and no chance of a roll-back in corporate tax cuts.

On that front, UK bookmaker Ladbrokes has Republicans at -120 to have fewer than 50 senate seats after the election, but that's down from -137 on Friday. The shift comes after polls in Iowa and Montana showed a tilt towards Republican incumbents.

Overall, there is a good argument that the market still isn't focused on the US election. There are always enough moderate Democratic congressment to block a corporate tax hike and that would leave the market comfortable with any outcome. The virus is the much larger driving factor along with easy Fed money forever.