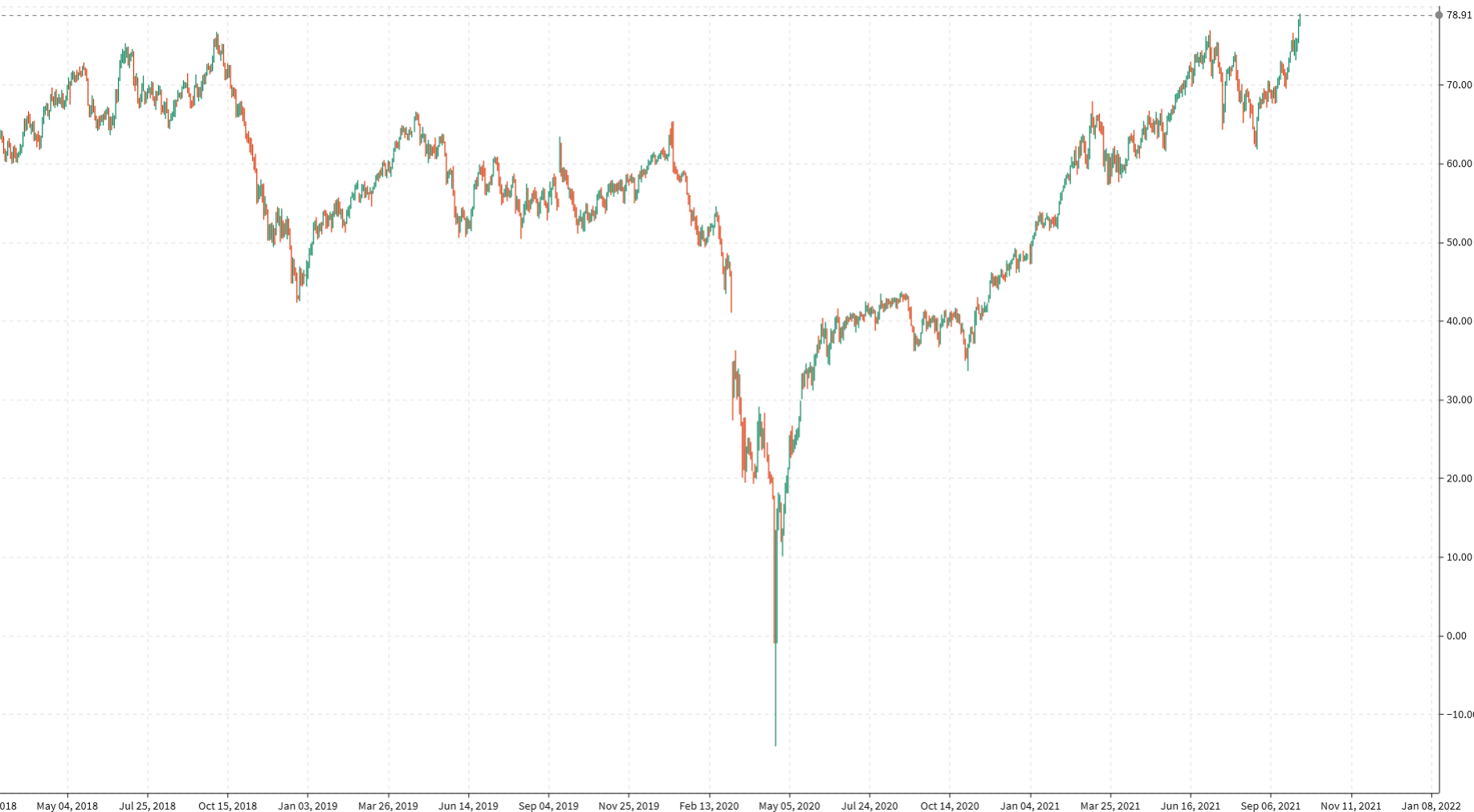

The oil chart looks better and better

Whenever there's a major breakout like we saw in oil yesterday, there's always a chance of a false breakout.

One positive sign though was that it came on a newsy day with the OPEC meeting providing somewhat of a catalyst. Today's price action is another good sign as crude hasn't just consolidated the move to a new range, it's extended it.

WTI just touched $79 fro the first time since 2014 and is up 1.75% on the day. I would note that this rally is also coming at what's usually a poor seasonal time of year for oil.

I'm detecting a huge change in sentiment. As I've been saying for a year, the issue is under-supply and under-investment. We saw Cathie Wood recognize this on the weekend and more generalist investors are realizing that we're going to need oil for a long time yet.

On the news side, a report said the US wouldn't offer Iran a sweetener to return to the negotiating table. As for Iran, time and pricing power appears to be on its side here.

In terms of technicals, you can paint a much higher picture from this breakout, something Scotia highlighted yesterday. The numbers you can come up with are jaw-dropping, so let's just start with $100.

Here's what TD has for US inventories:

They also highlight that jet fuel demand is down just 4% compared to pre-covid times. There's a growing risk of a demand-led surprise, at least until prices start destroying demand.

Flipping over to FX, we saw in today's Canadian August trade balance report that energy export values were only 6.7% from the 2014 record. That appears now sure to fall. USD/CAD at 1.2570 is too high for this kind of commodity environment.