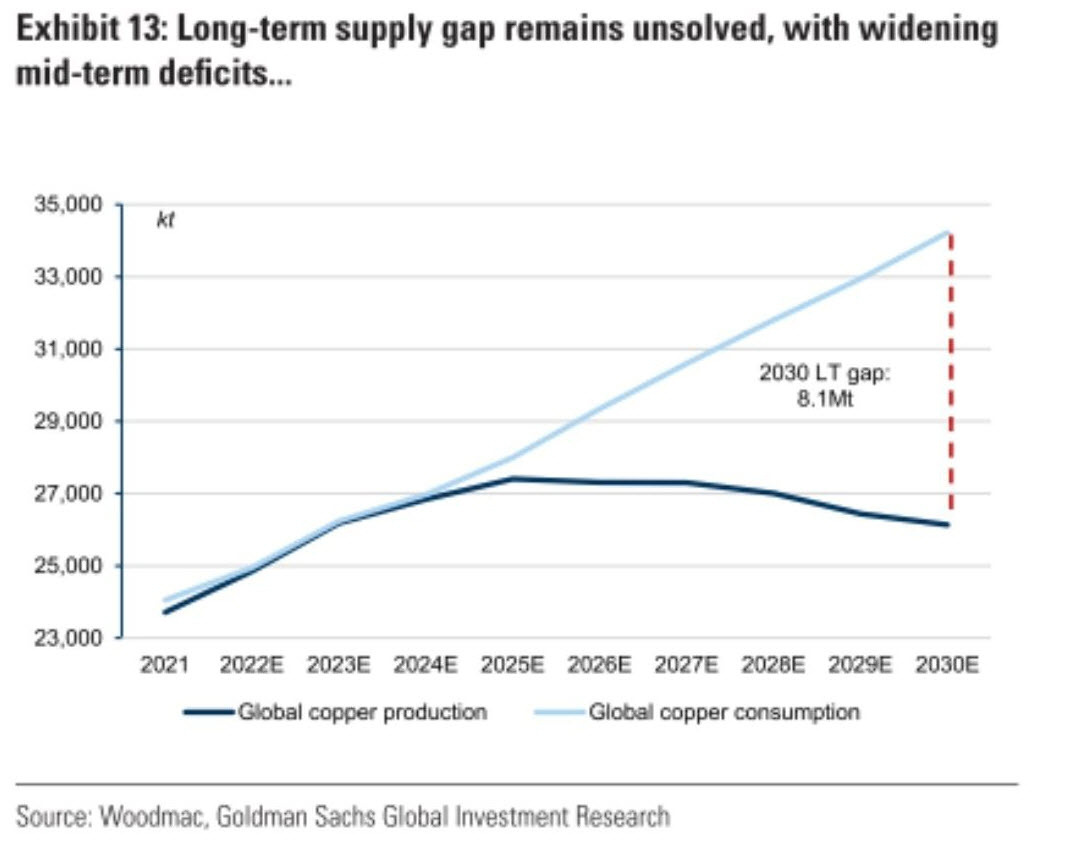

The best investments are often the simplest ideas. This chart from Goldman Sachs represents the single, most-compelling long-term investment that I know of.

We collectively spent the last decade investing in copper mines when we should have been investing in real mines.

I've written about this many times before but it's worth highlighting once again with two stories hitting the wires yesterday.

First, GM forecast that EVs will be 17% of sales by 2025. EVs use at least 2.5x as much copper as internal-combustion engines and the amount of copper in related infrastructure like charging stations and grid infrastructure is an order of magnitude higher.

Secondly, the CEO of Siemens Energy was warning on materials shortages, including copper.

“Never forget, renewables like wind roughly, roughly, need 10 times the material [compared to] what conventional technologies need,” he said.

This isn't just copper. It's the same with all electrification materials and metals. For some -- like lithium -- the forecast supply demand imbalance is catastrophic but I shy away from that because a battery-technology breakthough could kneecap the lithium trade. Copper is irreplaceable in nearly every application.

What can go wrong?

On the face of it, this is the no-brainer trade of the decade but everyone knows there's no free money in markets. What's the catch? Even US Congress recognizes the problem and is trying to cut timelines for permitting. The US military is even in talks with Canadian miners about grants to build new mines.

However even with rapid permitting, it takes at least 7 years from discovery to first copper and more-often 15 years. It's already too late to close the copper supply gap. Moreover, you'd think there would be plenty of copper to be mined as we've been using it for 3000 years but the amount of high grade discoveries in the last 7 years is nearly nil.

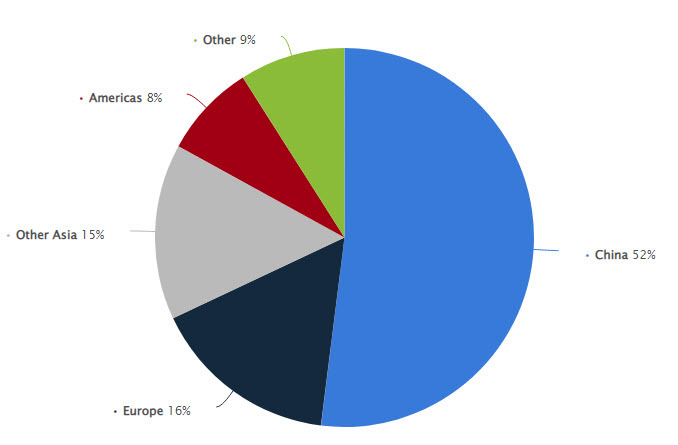

I worry about China, which is where 52% of the world's copper goes. An harsh recession there would badly hurt demand and could balance the market, though much of that consumption is for re-export in products.

The trade here is obviously miners, especially those near production and it's trade David Einhorn is making.

The trade has improved in the past month but it's still not hard to find a miner trading at 6x EV/EBITDA (at current copper prices) with 30 years of proven reserves.

I can't help but think the market is myopically focused on the near-term and copper oversupply through 2024 rather than the out years. No one wants to be long copper in a recession.

All that said, the reward in this trade looks to me to be far better than the risk and I haven't heard a compelling case for why it won't work yet. There's obviously a timing element to getting the trade just right but is timing it really all that important?

h/t @chigrl