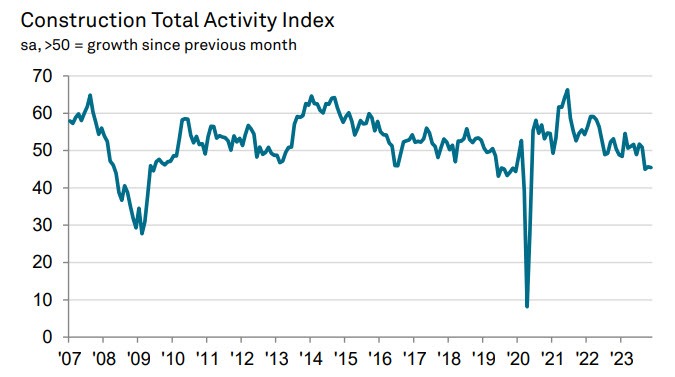

- Prior 45.6

This marks another contraction in UK construction activity with another sharp fall in house building weighing on the overall sector. Meanwhile, employment conditions also declined for the first time in ten months and that alludes to some softening in labour market conditions. But at least purchasing costs saw its steepest decline in 14 years, amid lower raw material prices and falling demand for construction inputs. S&P Global notes that:

"A slump in house building has cast a long shadow over the UK construction sector and there were signs of weakness spreading to civil engineering and commercial work during November. Residential construction activity has now decreased in each of the past 12 months and the latest reduction was still among the fastest seen since the global financial crisis in 2009. Elevated mortgage costs and unfavourable market conditions were widely cited as leading to cutbacks on house building projects. Rising interest rates and the uncertain UK economic outlook also hit commercial construction in November, while a lack of new work contributed to the fastest decline in civil engineering activity since July 2022.

"Improving supply conditions were evident again in November, linked to rising raw material availability and spare capacity across the supply chain. Greater competition among suppliers added to downward pressure on prices paid for construction products and materials. The latest survey indicated that overall input prices decreased for the second month running and at the fastest rate since July 2009."