- Prior +4.6%

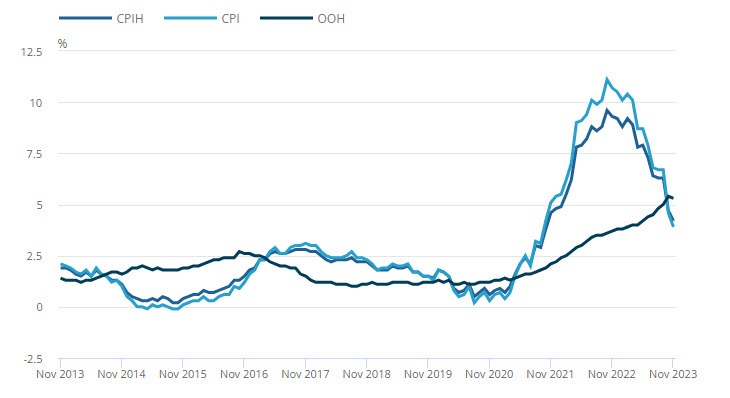

- Core CPI +5.1% vs +5.6% y/y expected

- Prior +5.7%

Despite pushback by the BOE, a clear miss on inflation data such as this one will continue to prove to markets that they are right to price in quicker rate cuts. The pound has fallen as a result, with traders set to look to pin down May as a potential first rate cut for the BOE next. The odds of that before the report were at ~65%, so let's see how that changes at the open later.

Going back to the report, the details show that food price inflation has also eased further with the annual reading now dropping below double-digits to 9.2% in November. With core prices also sliding more than expected, this may pressure the BOE into changing their rhetoric sooner rather than later given market pressure. But at 5%, I still think that is too high a benchmark for now.