Below 100 hour MA. Above 200 hour MA.

The EURUSD has been confined to a 30 pip trading range over the last 12 or so hours. The range for the day is not much better at 37 pips. The price is higher on the day. The pair closed at 1.1964 yesterday and we trade at 1.1976 currently.

Technically, the high today has seen traders leaning against the 100 hour MA (blue line in the chart above). That currently comes in at 1.19958.

On the downside, the 50% of the move up from the August 31 low comes in at 1.19573. The 200 hour MA is a little lower at 1.19504.

The pair is non trending and looking for a push.

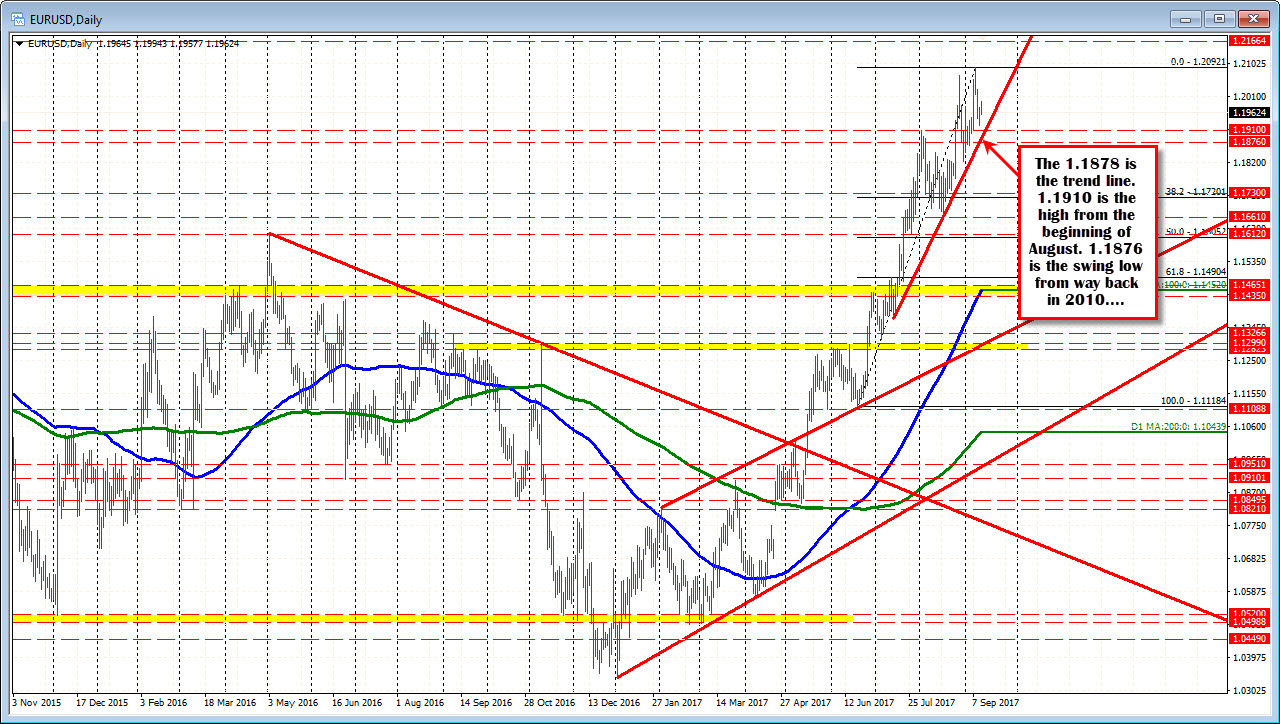

Taking a look at the weekly chart below, the pair on Friday last week pushed to the highest level since December 2014 at 1.2092. The high got within 4 pips of the move down from the 2011 high at 1.20968. Sellers leaned against that retracement and the 1.2100 natural resistance level.

Drilling down from the weekly to the daily, the price remains above a lower trend line at 1.1878. The 1.1910 is the high from the beginning of August. The 1.1876 level is the swing low from 2010. Those levels are targets below. Remaining above, keeps the bulls more in control.

In the last few minutes, the price has gotten a push down to the 50% and the 200 hour MA. So far the buyers are coming in near the area with a low at 1.19535 so far. We have extended the low by a few pips now.

---------------------------------------------------------------------------------------------------