Weak US data and rebound in DB on rumors held the recovery

The EURUSD got a boost on the weaker US spending data this morning, and is seeing further advances on the back of the DB rumors and rebound.

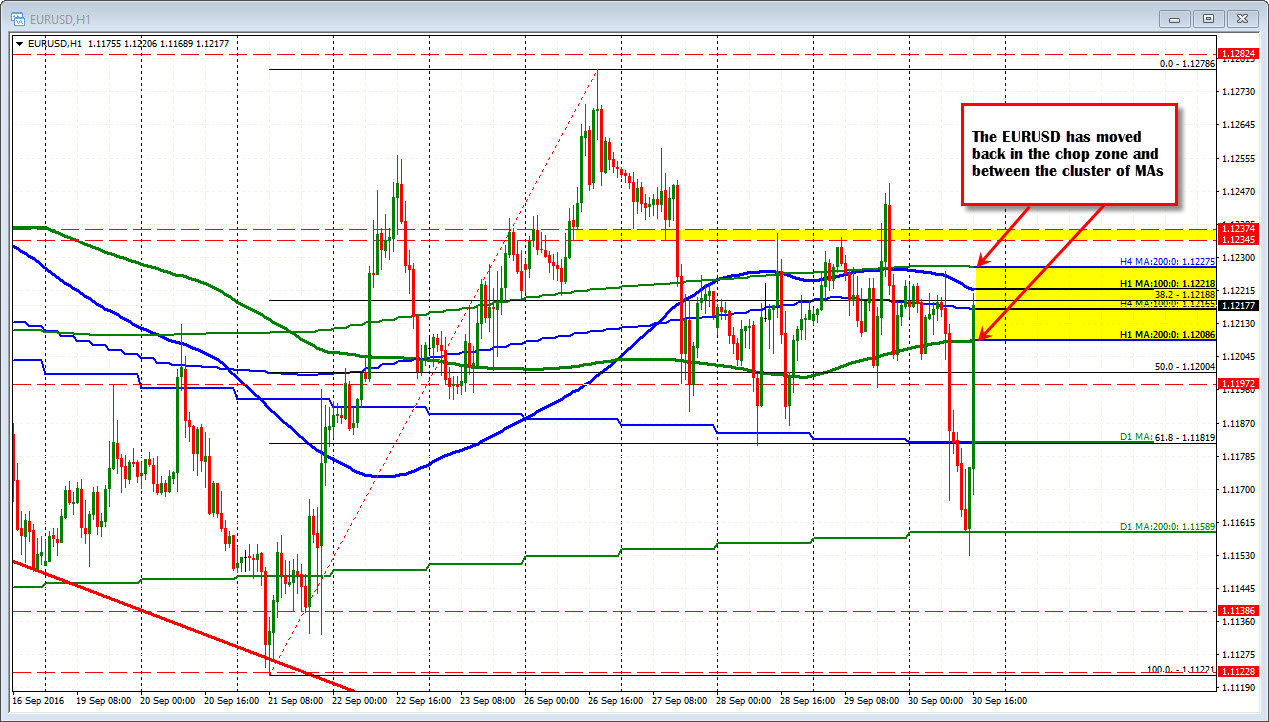

Technically, the price of the EURUSD has moved back above the 100 day MA at the 1.11819 and has moved in the area defined by hourly moving averages between 1.12086 and 1.12275 (see yellow area in the chart above).

The 200 hour MA is at 1.12085. That is the low MA line (and support). The 200 bar MA on the 4-hour is at 1.12275. That is the last line of MA resistance.

In between are the 100 bar MA on the 4-hour chart and the 100 hour MA at 1.12165 and 1.12218 respectively.

This area is where the market chopped around before the break lower earlier today. So traders are familiar with it's recent history. In fact the high today stalled against the 100 hour MA before moving lower in the London session. We are back high stalling against the level (at 1.12218). HMMMM. Traders remember. Traders lean and they leaned against the 100 hour MA on the first look.

The march higher has been a strong one, but we are back to where it all started. That is putting a bit of a lid on the advance.