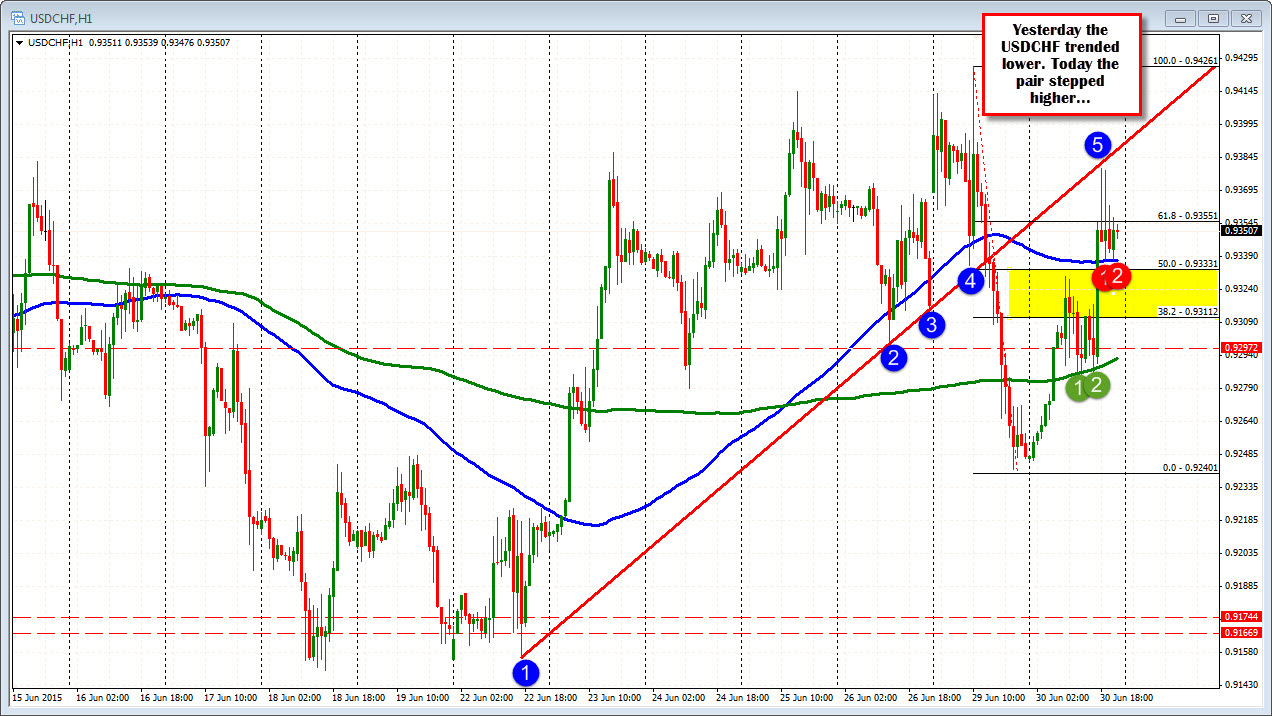

Steps on top of the 100 hour MA after stepping on the 200 hour MA.

The USDCHF trended straight down yesterday as the dollar got creamed. Today the technical story is a bit different.

Looking at the hourly chart below the price bottomed at 0.9240 area. The pair started to rally in the Asia-Pacific session and move toward the 50% retracement at the 0.9333 level and the 100 hour moving average at the 0.9336 level. The high on that move stalled at 0.9330. The subsequent fall to the price down to the 200 hour moving average (green circled numbers 1 and 2). There buyers leaned against the key moving averages and forced the price back higher.

The subsequent rally took the price above the 50% retracement and the 100 hour moving average (blue line in the chart above). That rally extended up to the underside of the broken trendline (blue circle 5). Sellers entered against that level and sent the price back to the 100 hour moving average were there now is support.

So in a step-by-step fashion, the USDCHF has methodically stepped higher with traders leaning against key technical levels to define risk, and limit risk on each move higher and corrective move lower.

Going forward, there is support below at the 100 hour moving average of 50% retracement level and resistance above against the underside of the broken trendline. Traders can lean against each extreme. Look for the next break. It seems a simple as taking one step after another.