The one that cut rates and increased QE by 20B

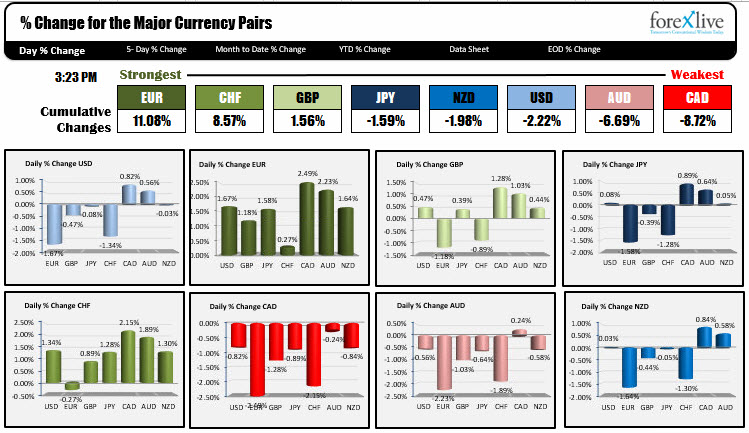

The EUR surged by 1.67% against the greenback, by 1.18% against the GBP, 1.58% against the JPY. Against the commodity currency countries, it rose by 2.49%, 2.23% and 1.64%. What a day.

Will the actions today by the ECB ignite the economy/inflation?

It is only one day but in addition to the currency being higher making imports cheaper and exports more dear (that does not help inflation or the export economy), the Dax was down -2.31% The Eurostoxx was down -1.51%. This side of the ledger does not seem like it will help matters... economically that is.

On the other side of the ledger, there were a lot of moving parts in the decision including cutting the Main refinancing and lending facility rates by 0.05% each (that is not a lot) It is not like they lowered rates by 50 basis points or 25 basis points. However, they did increase QE by 33% to 80B per month from 60B. That is something....Where will that extra money go to? Will it go to lending or will the funds earn negative interest? Even European bond yields were higher today.

Gold rose by 1.1%. Oil prices were down -0.89% but by comparison, that is unchanged. So some relief there. But overall, the EUR being the strongest currency on a day like today....and by a lot, is not a good start to the kitchen sink throwing.