The quid pushes higher as the UK economy shows it's not ready for the scrap heap just yet

Mixed emotions for the GDP data. We did better than Q3 but growth has slipped below 2% y/y. A sign of the times that growth is hard earned and hard to come by. Domestically we're still doing fine but it's outside our borders where the weakness lies. EURGBP might start helping now it's gained around 10% from the lows, lessening the pounds strength in trading with Europe. With the ECB still in full QE mode it's hard to see that rising too far

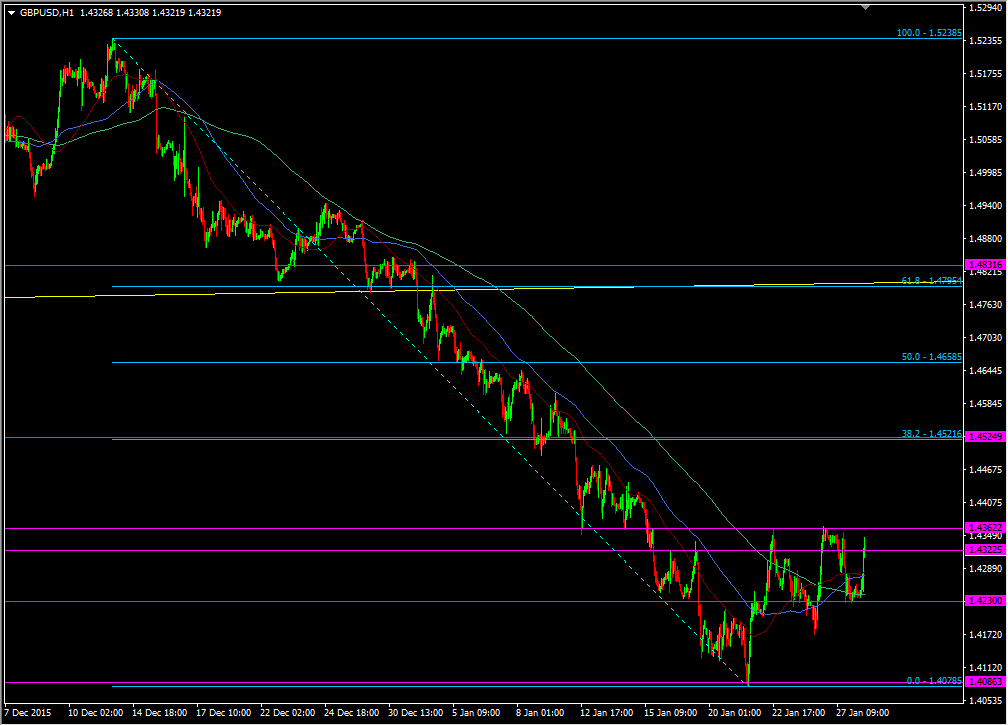

Meanwhile cable has had another look at the upside of the recent ranges. 1.4360/65 remains the gate we need to get through to increase chances of a higher push

GBPUSD H1 chart

We've seen resistance coming in ahead of 1.4350 both yesterday, and now in this latest run. It's been forcing longs to sweat and they've been quick to get out when the push has failed. That shows a lot of nervousness among buyers but if they can break up above here then we should see the level building some support, giving the buyers a shot in the arm to tackle 1.44

1.4500/30 still remains the bigger level down here. Through 1.4400 there's likely to be resistance around 1.4420/25 and 1.4475/80. There's nothing that looks overly strong as there wasn't much on the way down from 1.4500. We'll have to see how things develop but I wouldn't be very keen in shorting levels through 1.4400

So eye's peeled for signs that the rally balloon could run out of air, as it is as I type. Longs will want to see 1.4300 hold and a break of support at 1.4280 will see the white towel fly through the air