Yen pairs are on the rise

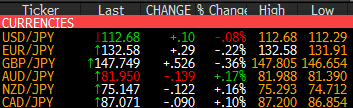

Yen pairs are trading near their best levels on the day now with USD/JPY and EUR/JPY both touching session highs of 112.68 and 132.58 respectively. The yen is slipping on the day as Treasury yields continue to climb while E-minis are also inching higher.

US 10-year yields are now up 1.5 bps to 3.078% while S&P 500 futures have pared some of its earlier losses to be down by 0.15% only.

Looking at the chart for USD/JPY, near-term price bias remains more bullish as several attempts to sustain a break below the 100-hour MA (red line) since last week has failed. And that continues to fuel further upside in the pair as we begin the new week.

With Treasury yields looking to move higher, it's providing the right kind of momentum for yen pairs in general to move up alongside it. USD/JPY now looks poised to move towards a test of the July high @ 113.17 as long as yields continue to support the story. There's minor resistance seen next @ 112.80 but if yields are heading towards a breakout, then yen pairs are set to follow suit too.