Oil fever hitting the loonie once again

One day the BOC might have an influence over the currency but for now, we're in oil la la land.

The way we've broken 1.3190 and 1.3200 has shown that the rally may have some real oomph behind it.

USDCAD 15m chart

The key indication is that it found support around the 1.3195 area and now that support is trying to step things up to around the 1.3215/20 level.

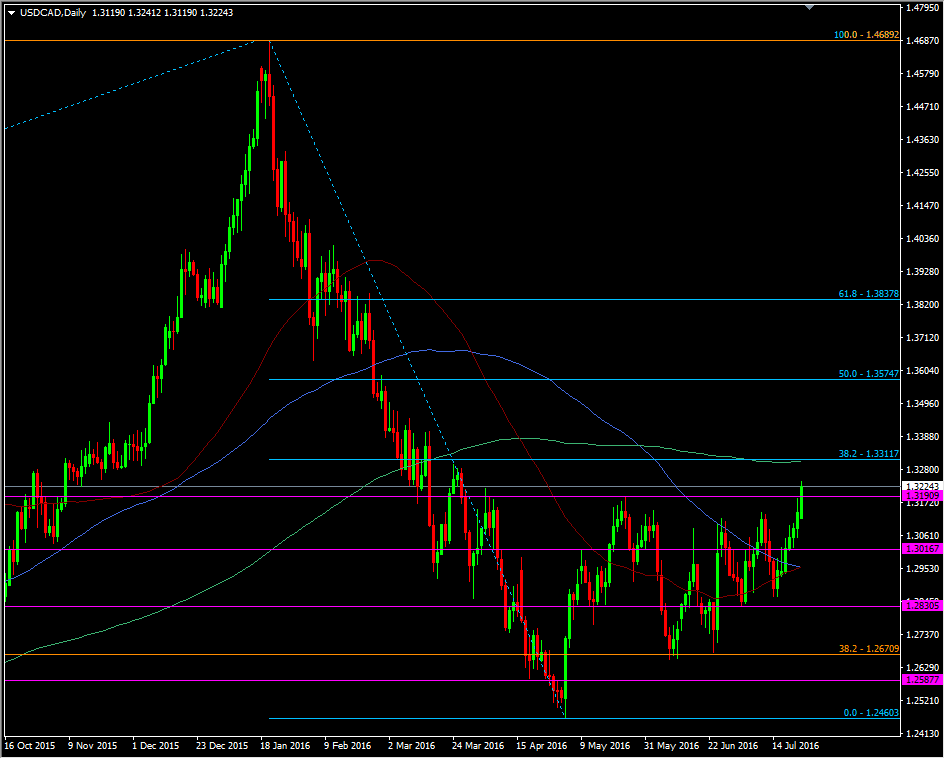

The next target is the 55 wma at 1.3264 followed by the late March highs around 1.3285/90. The bigger level is the 200 dma at 1.3305, and 38.2 fib of the Jan drop at 1.3312.

USDCAD daily chart

There's yet another opportunity here for a Fed trade if the current oil weakness persists, meaning that USDCAD is well supported. A decent Fed induced dip could be another great buy as it will go against the bearish oil price. The question will be how far USD/Fed traders allow this pair to roam vs the oil side of the trade? Too high and we may see some USD sellers finding the opportunity too great to resist. Right now before the Fed, the 1.33 level looks to be the strongest place to either take profit on longs, or to think about a quick counter move.