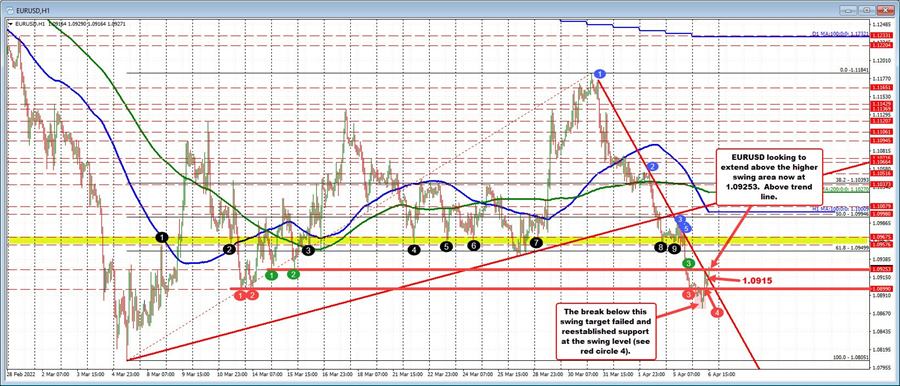

The EURUSD moved lower yesterday, bottoming near the close at a lower swing level at 1.0899 (see post yesterday here). That low was also near the close for the day and also saw a higher swing area at 1.09253 taken out in the process. The pair also stayed below a downward sloping trend line (albeit a steep line).

Today, the pair moved below that target swing level and the natural support near 1.0900, moving down to a low of 1.08736. The price bounced and squeezed back above the 1.0900 level (uh-oh - failed break?), and moved up to the higher swing level at 1.09253. After a move back to retest the 1.0900 level held (final test - see red number circle 4), the traders took that clue as a go-ahead to push higher (support was reestablished). The price has moved to a new high as US traders enter the fray.

Further gains have now taken the price above the trend line near 1.0915 and above the 1.09253 level. The high just reached 1.09371.

Overall, after 4 straight days of declines that took the price around 310 pips from the high to the low today, the buyers have made a play back above 1.0900, 1.0915 and 1.0925.

Are the buyers in full control?

No...there is work to do. Getting above the broken 61.8% at 1.09499 and swing area between 1.0957 and 1.0967 - black circles- are the next targets.

More importantly for the dip buyers perhaps, is to stay above the aforementioned broken levels. A move back below 1.0925, 1.0915 trend line and for sure the 1.0900 (1.0899) would not be what buyers want to see. So it the risk for dip buyers vs the reward for now.

PS the 38.2% of the move down from the 4 day decline comes in at 1.0992 (close to 1.1000). The closer targets are still a good way away from that minimal retracement target, but it also shows the potential IF the buyers can stay above the failed levels below (esp. 1.0900).