The JPY is the strongest while the GBPUSD is weakest as the North American session begins. The USD is back to being stronger after 3 days of declines. IN the UK the inflation data came out and its highest level in 40 years. Although keeps pressure on the Bank of England to continue to hike rates, traders don't like the implications to the growth prospects. Meanwhile Brexit concerns resurfaced as the UK intends to stop checking goods going between mainland Britain and Northern Ireland.

Crude oil futures are higher after a decline yesterday. The private inventory data showed a surprise drawdown of inventories (were expected a rise in inventories). The national average of gasoline prices reached $4.56 yesterday

Stocks are lower after the solid gains yesterday. Target and Lowes announced weaker earnings this morning which is helping to weigh on the major indices. Target shares are down close to 25%. They cite decreasing margins as a result of higher prices. However they do say that consumer demand remains strong (but will it remain strong if prices are increased?).

There has been large blocks sales going through US debt market. Yields are higher across the curve. Gold is following the whims of the US dollar. With the dollar higher, gold prices are lower

A look around the markets is showing:

- Spot gold is down -$5.59 -0.31% at $1808.78

- Silver is down $0.03 -0.18% at $21.57

- WTI crude oil is trading at $115.12 up 2.5%.. Fuel prices are up 70% year-over-year

- Bitcoin is trading back below the $30,000 level at $29,860.53

In the premarket for US stocks, the major indices are trading lower as concerns about inflation and impact on earnings weighs on the indices

- Dow industrial average down 180 points after yesterdays 431.17 point rise

- S&P index down 29.55 points after yesterdays 80.82 point rise

- NASDAQ down 136 points after yesterdays 321.73 point rise

In the European equity markets, the major indices are trading mostly lower

- German Dax -0.2%

- France's CAC -0.25%

- UK's FTSE 100 -0.25%

- Spain's Ibex +0.3%

- Italy's FTSE MIB unchanged

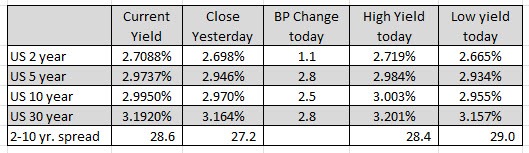

In the US debt market, yields are up about 3 basis points. A huge block of treasury sales reportedly a European fund that is lowering duration is responsible.

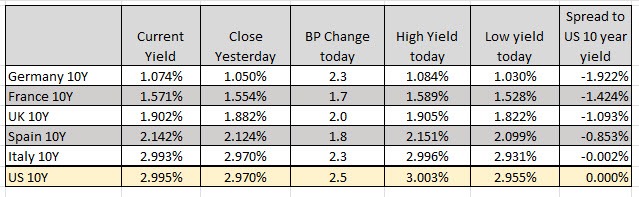

The European debt market, the yields are also higher across the board: