We've had some comments from Bank of Japan Governor Kuroda today, posted here

Here is an earlier piece via Bloomberg, over the weekend: Bank of Japan Governor Haruhiko Kuroda is starting to convince bond investors he can revive inflation without extra monetary easing.

- The yield curve suggests buyers have been unwinding bets that the BOJ will expand purchases of long-term debt, while a measure of market volatility declined to the lowest in more than a year.

- What Kuroda has done is focus attention away from the core consumer-price index

- The BOJ began publishing an alternative gauge that strips out both fresh food and energy prices, and which showed inflation rose at a 1.2 percent clip for a second month

"With the BOJ publishing its own consumer-price index while stressing the importance of looking at a variety of indicators, it's starting to win market participants over," said Makoto Suzuki, a senior bond strategist at the Japanese brokerage. "That core CPI is negative is not really a big deal, though the central bank is still far from reaching its target."

There is more at the article.

- The official CPI from Japan on Friday is here

- While the BOJ's own CPI measure is here

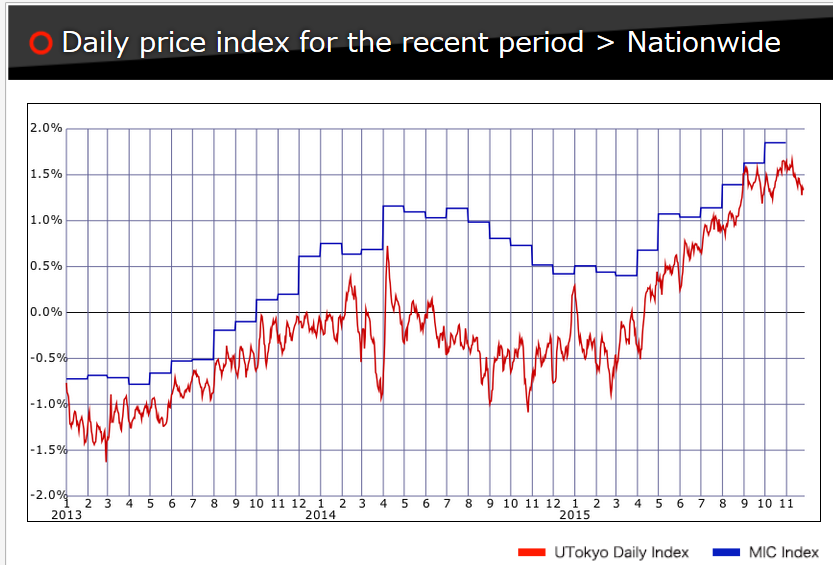

Kuroda has also been referring to the uTokyo inflation measure, which is also indicating rising prices:

(ps. .... More from Kuroda crossing the wires:

- Desirable for forex to move stably reflecting economic fundamentals

- Weak yen has positive effects on exports but hurts household income, small-firms' profits