The BOE’s quarterly lending report “Trends in Lending” has found that SME’s would still prefer to repay debt than borrow new money.

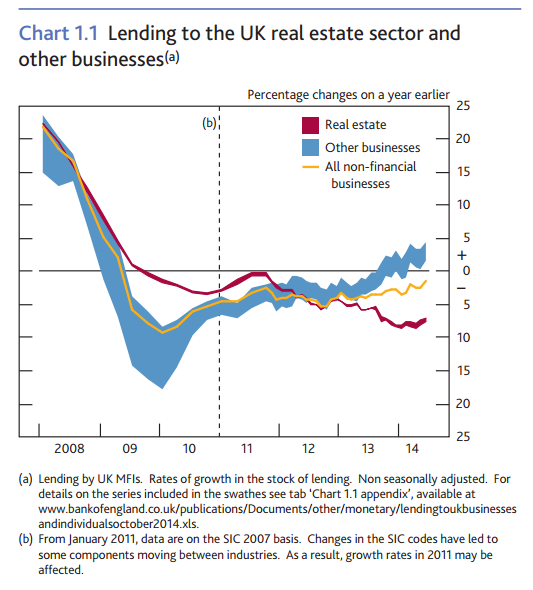

Overall lending to private non-financial companies in the three months to August was more or less flat q/q but showed a drop against a the same period a year ago. The real estate sector led most of that weakness and accounted for around 30% of the total stock of loans. Other industrial sectors other than real estate limited the fall in lending.

BOE quarterly lending report 20 10 2014

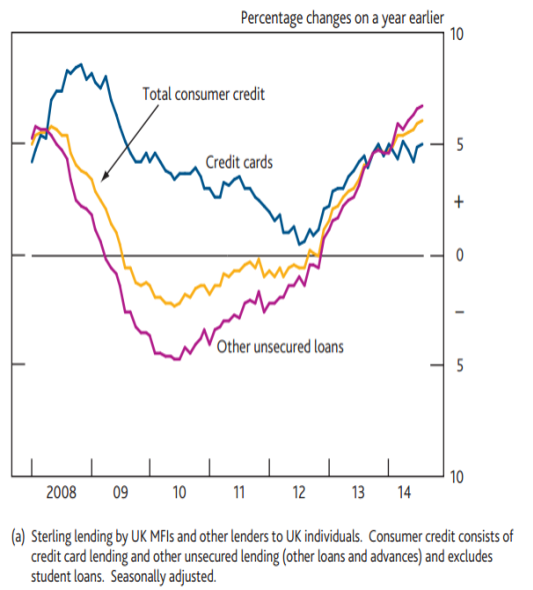

The consumer continued to increase borrowing, which increased to 6.1% y/y in August on credit borrowing. Unsecured lending rose to 6.8% y/y.

BOE consumer credit 20 10 2014

There’s some worrying news within the report, particularly the consumer numbers. The BOE are happy to point out that we’re still below pre-crisis levels but the the direction on the chart above shows that we’re heading back to those levels. If it continues then there’s going to be more than a few pockets pinched when rates go up. It seems that either people are still not clued up enough that they should have been reducing their debts or that there are many who are still reliant on the old plastic to get through the month. No one should really be crunched by a 0.25% rise in rates but if they’re up by 2% in and around the next 2 years people will feel the heat.

The drop in borrowing to the real estate sector is probably something we saw in the recent drop in construction data for August, and it’s something that may cause the sector to continue to fall.

On the upside, the fact that companies are still reducing their debts is good news. It might paint a picture of weak lending but it makes for stronger company finances which is what will help keep the economy moving forward, although it might mean it moves at a slower pace.

The consumer aspect is the one we need to keep a close eye on but aside from that, the report doesn’t suggest (right now) that we’re heading for another big blow up in borrowing that will end in tears 10 years down the line.