Bank of America analysts like the US dollar, saying they "see scope for the USD's resilience to continue."

BoA make some useful points in the note, spanning the dollar and the Federal Reserve:

- Signs of growth divergence continue to favour the US. pulling up nominal and real rate differentials

- the mix of robust growth along with disinflation can suggest that central banks do not need to risk over-tightening, while at the same time, the economy could find equilibrium at a higher neutral interest rate

- Fed funds pricing for the remainder of 2023 has been stable, suggesting that the market believes that the Fed is at or near the terminal rate

- And while we see scope for even more cuts to be priced out for next year, the Fed funds futures (FFF) curve spanning 2024 has already removed -50bp of cuts since immediately after the June CPI.

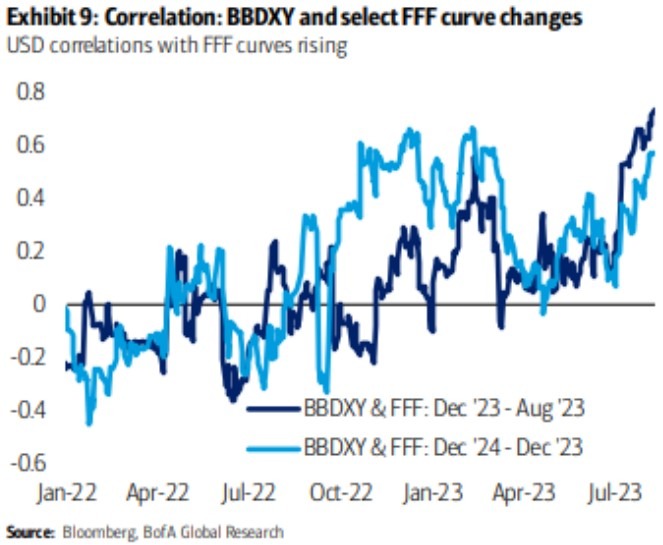

- the USD's correlation to changes in the 2024 curve is rising

- Going forward, the focus will likely shift from the "higher" part of policy guidance to the "longer" part

Bolding above is mine.

To illustrate the USD correlation with Fed Funds BoA print this graph: