Day four of our Guest Trader feature and after yesterdays events Alex is seeing heavenly bodies. Catch his previous posts here.

Written in the stars

Today, I will combine the ‘Food for thought’ and ‘Chart Analysis’ section into one, as what I stumbled upon yesterday threw me down the rabbit hole and could possibly be a complete game changer. And no, it’s not the ganja talking.

As yesterday post FOMC action shows, especially on XAU/USD, it doesn’t matter how oversold or overbought your indicators are. It doesn’t matter whether or not there is a harmonic pattern urging you to trigger orders.

The problem is that human beings suffer from cognitive bias all the time and are mostly unaware of it. Even worse, we believe we can be objective, especially when it matters most, and yet fool ourselves so badly.

Let’s take another look at this sordid business of technical indicators. If you are not a total noob, by now it should be pretty obvious that indicators are only a synthetic view, a summary, of a particular aspect of past price action with no predictive power whatsoever.

In retrospect, when you look at a chart and see how this or that line curves right there where it seems that price just significantly changed direction–“by Saint George and Merry England, I can see the future!”, you exclaim with a sudden sense of having become a Master of the Universe. Wrong!

All we see is the price already having performed its significant action at some significant level at some significant point in the time stream (more on that shortly), thus leading the indicator on just as our cognitive bias leads us on to confuse price –> indicator movement correlation for indicator –> price movement causation.

When I was a greenhorn, I’d ask all the time: “Which indicator is most meaningful? Which matters most? Which one will show me the future? Come on!”, and would proceed by putting down the gun on my right and a pile of 100Gs cash on my left and say in the worst impersonation of Robert De Niro imaginable : “So, what’s it gonna be wiseguy?”

Alright, I made that last bit up, but it exemplifies the lunatic state of mind I was in until, one day, I finally realized that what matters is whether or not we have key price action at significant support/resistance levels combined with a valid assessment of momentum, and suddenly the indicator becomes justifiable eye candy, if only to impress that significant other that this is no joke and you mean business. ;D

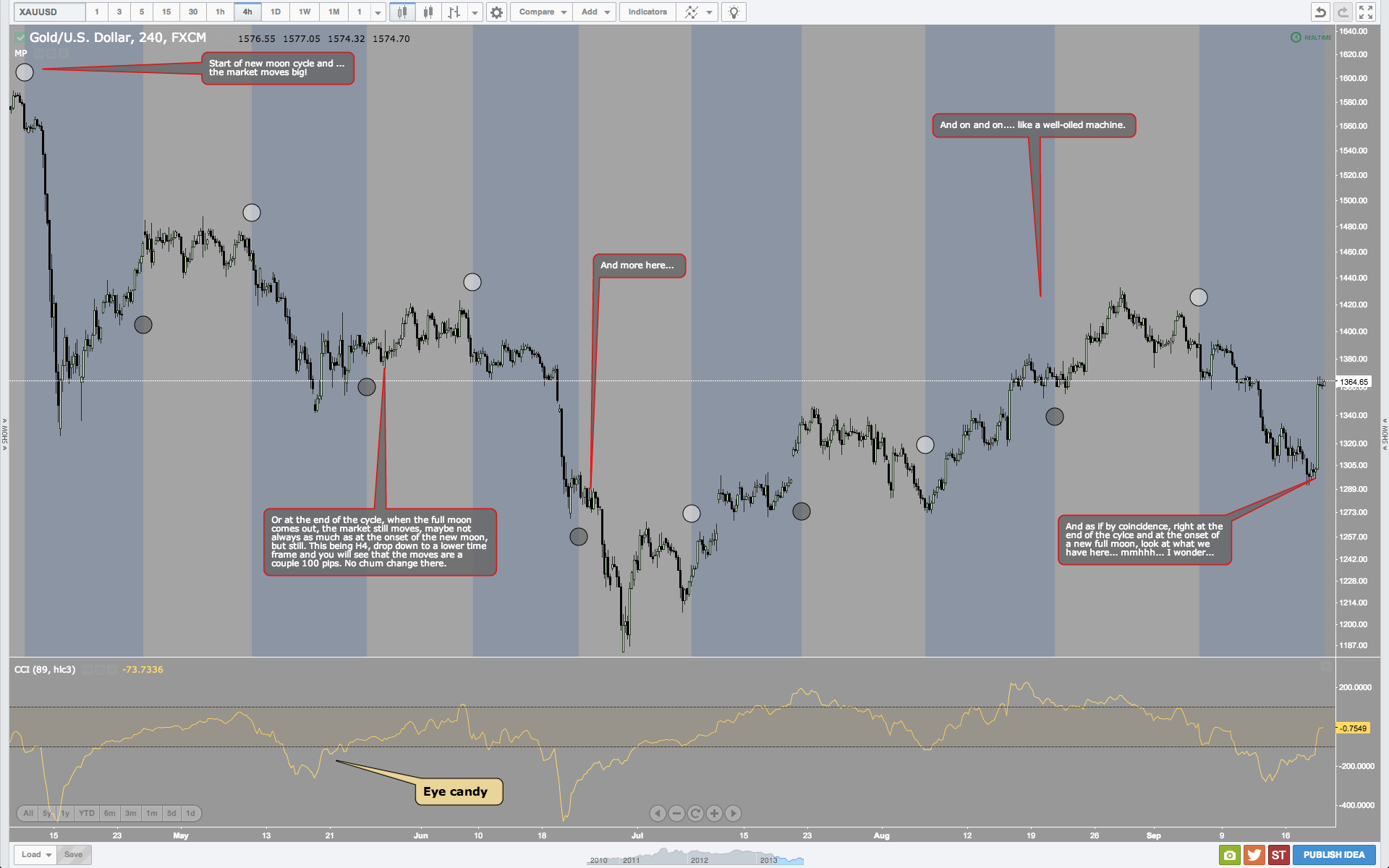

But wait, there is more! Look at this chart and … be A-M-A-Z-E-D! Could it be? The secret of the Ages finally revealed? (open in new tab)

Gold vs Moon (open in new tab)

I usually scoff and frown and scowl, and eventually reach for my gun, when I hear the word ‘astrology’. But let it not be said I don’t have an open mind. If a trader like Larry Pesavento (of ‘Trade What You See’ fame) endorses this guy: Tim Bost, Market Astrologer, and takes astro-trading seriously, then who am I to say otherwise?

I mean, seriously, look at that chart again. Isn’t it uncanny?

So there you have it. Planetary cycles and market cycles, all bound and oscillating within cycles of time.

Time! Think about it… the greatest riddle of all.