Markets tip tough Fed call, BOJ down to interpretation

The futures and options markets at times offer clear insight into what is expected from central banks. Other times, it's down to interpretation.

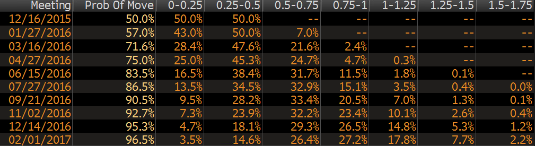

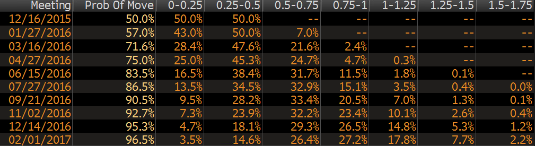

The Fed and BOJ decisions in late 2015 perfectly highlighted the contrast. In the United States, the Fed funds futures market is a clear example of how probabilities can be visualized.

The October 28 FOMC statement featured a surprisingly hawkish tilt that pointed toward the December meeting as one where the Fed could hike. Prior to the statement, the implied probability of a hike was 34% but it has since jumped to 50%. That rise has helped to boost the US dollar.

It's not just the front month, the chance of two hikes by June has now risen to 45% from 30%.

The BOJ is more complicated

Understanding what's expected a central bank is part art and part science. Implied probabilities and economist surveys are only part of the equation.

The Bank of Japan is an example where there is no guideline in the futures or options market about what's expected. With rates already at 0.10%, there is no way to cut rates so officials must rely on expanding the BOJ balance sheet even further.

The market tends to look to economists for guidance. A Bloomberg survey showed 16 of 36 analysts expecting more easing today

However that likely overstates what the market is expecting. Economists are loath to change their 'calls' and the latest BOJ commentary has pinned the blame for low inflation on commodities while forecasting a pickup in growth. (update: the BOJ didn't ease).

A final measure to watch with the Bank of Japan is always the clock. The Bank of Japan doesn't have a set time for interest rate announcements but the average announcement time is 12:22 Tokyo time (0322 GMT).

When the BOJ eases, the meetings tend to take longer so as the clock approaches 1 pm and beyond, expect to see the yen slumping as more QE or other easing is priced in.