EURUSD may have be down today but there's interest building in the dips

There's probably still some way to go before we move to the next real direction but already traders are taking a different view of things

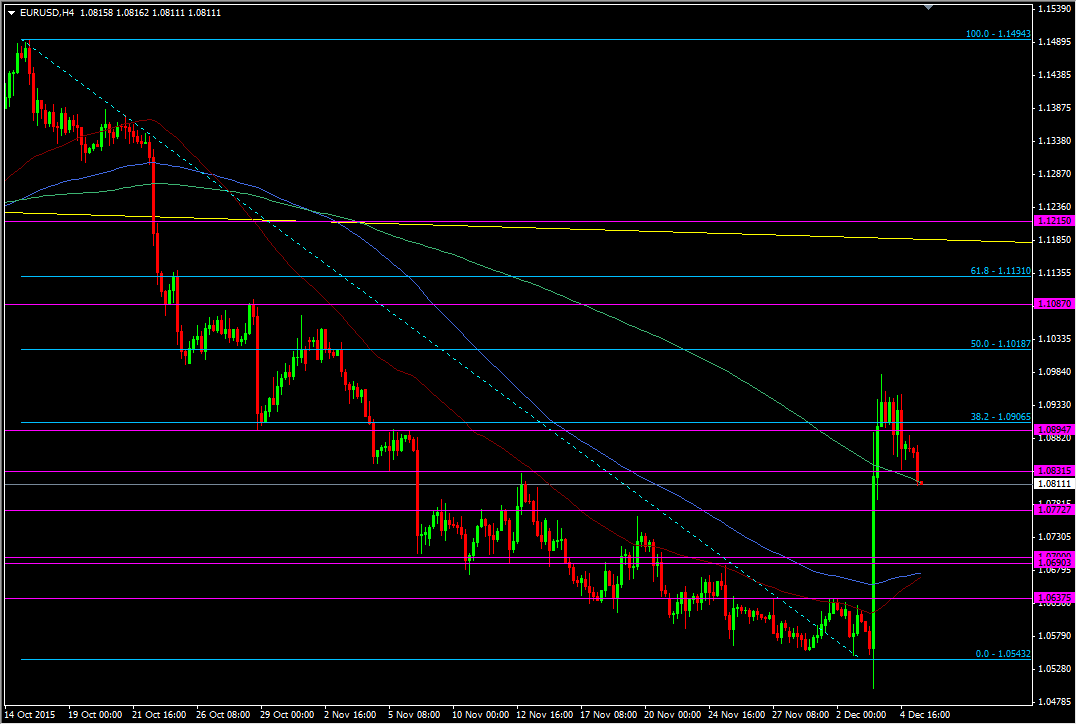

The bids that were at 1.0820/30, and those at 1.0790/800 and 1.0750 are said to contain buying that will be initiating fresh longs. Interbank and real money that are short are not looking to add to existing trades at these levels but would prefer to wait and see if the price gets back up towards the ECB/NFP highs

The 1.0830 level was where I was looking for the price to find buyers last week and it looked like it was doing the job until today. The next key level was the 1.0800 big figure and we're seeing that protection come in at 1.0810. Under 1.08 1.0775/80 is likely to hold decent support too

EURUSD H4 chart

Shorts are still very much in the game and they would have been watching the reaction between the 38.2 and 50.0 fib of the Oct fall carefully. Trading desks note that a lot of euro shorts were initiated around the 1.11 area so the 61.8 fib is likely to be a very key level for those and if it breaks could bring a further squeeze

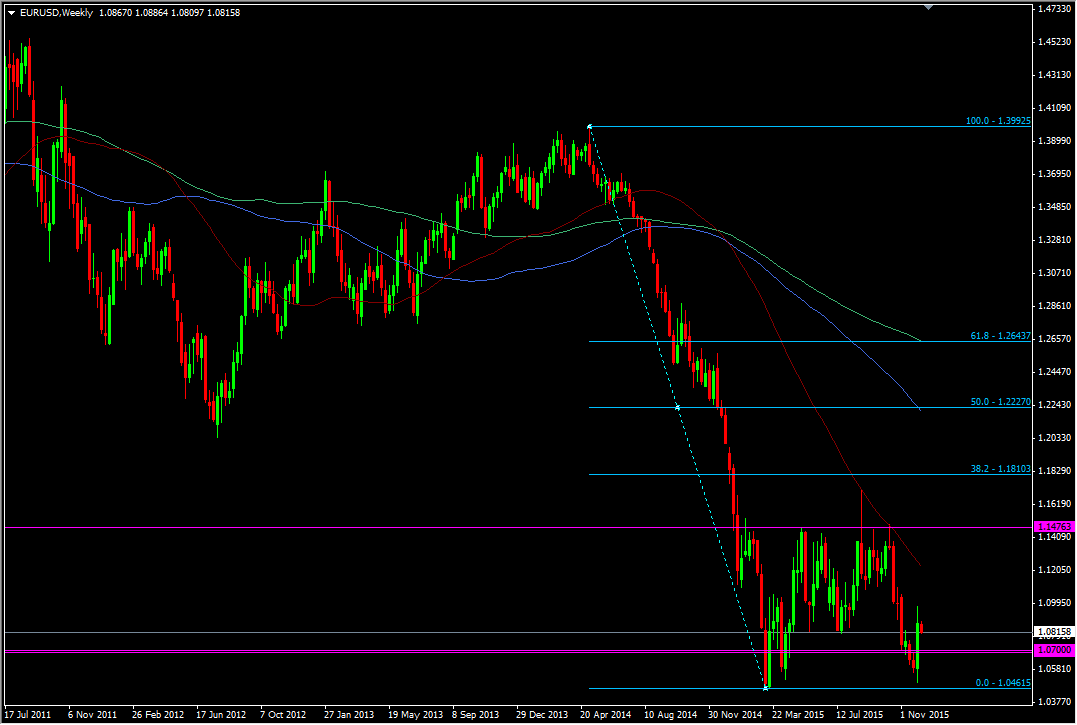

It's very easy to say the ECB failed to deliver and we're going to 1.20 but I view those calls in the same way that I viewed the parity calls, i.e with a huge pinch of salt. A look at the weekly chart shows how far the market has to turn around to really change the selling trend

EURUSD weekly chart

From the fall from 1.40 we've still not managed to come close to the 38.2 fib at 1.1810, and the longer term shorts won't even starts to feel nervous unless we get a test up near the 50.0 fib at 1.22+

So if the market can't rise to the 50.0 fib over the ECB on an intraday basis, how is it supposed to jump to the 50.0 on a longer timeframe? That marks the difference between people who pick prices out of the sky and traders who look at the charts and see what's actually involved

Now you may say, "that's all well and good Ryan but put it in terms of how to trade it now".

Let's take it in stages;

First the short term

We now know that players are looking at fresh longs so that marks a change in sentiment, which is something we needed to be watching for as it changes the dynamics of trading the euro. We also know there's still interest to add to shorts but higher up. We also still have the FOMC to come. That suggests that we are likely to find ourselves stuck in a pretty tight range. If I had to put a number on it I would say look to roughly the 1.07 -1.09 range with 1.0950 an outer level. Under 1.0800 we've still got to see the support develop but looking at the broken levels on the way up is a start

For the longer term

It will be after the FOMC that we will get the next big directional move and a big part of that will be decided by the message the Fed gives next week. It's pretty much nailed on that they hike but if they don't then we're going to see the euro blow higher. If they do hike then we must carefully watch the action after. If we stay somewhere above 1.0600 on the initial reaction to a hike, then that could well mark another bottom and that's when we may see a real change in the bearish trend. If that's the case then the first target will be the 1.1475 - 1.1500 level shown above on the weekly chart

Trading is never black and white and there are all sorts of traders. Everyone is in the mix at different times and sometimes at the same time. It's futile slapping price targets on a currency as it's more productive to find the levels that may make or break a particular move, be it long or short term. Whatever your style of trading you should make yourself aware of the levels on all the timeframes so that you can build an overall picture in your mind. If you don't ignore a fib or moving average on a 5 minute chart then you shouldn't ignore them on a weekly chart