I've posted previews of the Reserve Bank of New Zealand monetary policy announcement to come on:

- Thursday morning, June 28 local time

- Wednesday 27 June at 2100GMT

Here:

- RBNZ meeting - 'on hold' expected - but here are 3 things to watch in the statement

- Its RBNZ week - preview of the announcement

- ANZ on the RBNZ, expect the next rate move in ... 18 months

- CBA on the AUD this week, and on the RBNZ

- RBNZ meeting coming up - 'shadow board' recommends no change to cash rate

This now via BNZ / NAB:

Thursday's RBNZ OCR Review … expected to come and go without any ruffles

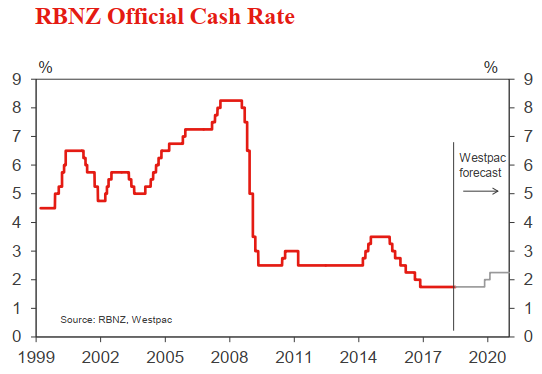

- It would appear to take a lot to budge the Reserve Bank from its on-hold mentality. Its opening line from May's Monetary Policy Statement that "The Official Cash Rate will remain at 1.75 percent for some time to come" is as clear as you can get

- But, as they say, time will tell.

- GDP might have undershot the Bank's forecasts, but the CPI still looks likely to beat them (in our view, at least). Also bear in mind that the RBNZ might be less inclined to simply edit the prior policy summary page, instead fashioning each new one from the ground up.

- So be careful not to over-read what might be added to, and dropped from, the front page text compared to May's MPS.

And, Westpac:

We expect the RBNZ to repeat its main message that the OCR is likely to remain on hold for a long while, but that the timing and direction of the next move will depend on how the economy evolves

- Focus on whether the RBNZ repeats the words "up or down" in its policy guidance is a red herring. The RBNZ is keen to avoid formulaic communications. They may well choose different words but this would not necessarily constitute a signal that the OCR outlook has changed

- Beneath the policy guidance paragraph, the details of the press release might be slightly more hawkish than the May statement