I’ve a feeling it’s going to be a very slow day today (let’s just hope I’ve given that the kiss of death). EUR/USD has gotten back to old ways of carving out the upside, albeit very slowly. The 2008 trendline at 1.3808 may have another say in matters, as it has done previously, if we keep trying the upside.

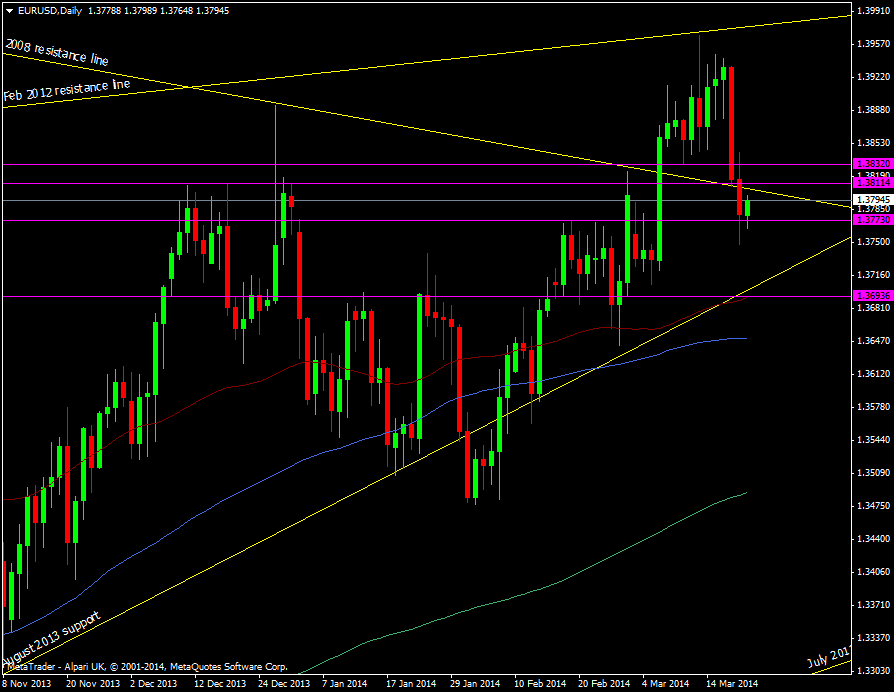

EUR/USD daily chart 21 03 2014

Above there 1.3832/40 will be the next resistance area to overcome.

Down below 1.3765 has mild support as does 1.3750 with stronger down towards the Aug 2013 support line at 1.3699 and 55 dma at 1.3693.

UBS are out with a note that any short term recovery from the FOMC drop may be temporary as the previous “forces” that kept the euro buoyant are waning. The gist, they say, is that the single currency will become more vulnerable to Fed actions this year which will see it fall towards 1.25 by year end.