The dollar keeps weaker ahead of the Fed

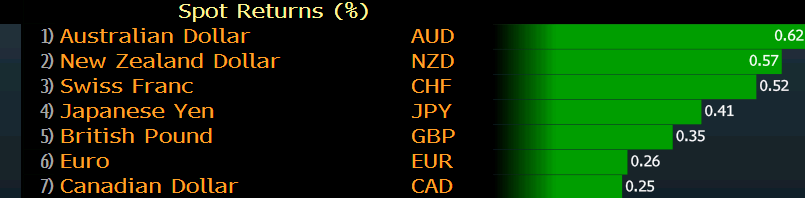

The greenback isn't getting much of a reprieve despite a slight pullback in equities during European morning trade, with the dollar still seen weaker across the board.

The franc is a notable gainer, and is posting decent gains of around 1.7% against the greenback so far this week after SNB sight deposits declined for the first time since January - in a sign that the SNB is relaxing a little after months of heavy intervention.

But in any case, all eyes are on the Fed later today with a couple of main points being any indication of yield curve control and how the Fed will assess the current economic situation and what will be their response to that i.e. will they keep the party going?

Barclays

- Expects the Fed to clarify its intentions on asset purchases

- Fed has scaled purchases back as overall functioning has improved

- Expects the Fed to shift its commitment from daily purchases ($4.5 billion in both Treasuries and agency MBS) to a monthly purchase rate of $80 billion in Treasuries and $60 billion in agency MBS instead

- Does not expect a change in forward guidance

- Expects median assessment of monetary policy to include keeping Fed funds rate at zero lower-bound through the end of 2022

Danske Bank

- Not expecting the Fed to make any significant changes to policy stance

- Looking for two things i.e. whether or not the Fed will change its forward guidance and changes to asset purchases to a monthly figure

- Thinks it is too early for Fed to change forward guidance at this stage

- Fed will make clearer what conditions for tightening policy moving forward

- Does not think the Fed will gain much by shifting to monthly asset purchase target

- Does not expect the Fed to implement yield curve control (YCC)

Citibank

- US jobs report should keep policymakers more upbeat going into the meeting

- But it is unlikely to substantially change decisions/forecasts

- Says that the forward guidance is likely to be paired with a weak form of YCC

- Commitment mostly to front-end yields to reflect policy path implied by guidance

- Economic projections should show a median for no rate hikes through 2021

Deutsche Bank

- Expects the Fed to take its first step away from a crisis prevention back towards the goal of providing accommodative support for the recovery

- Expects the Fed to announce open-ended QE consistent with monthly purchases of Treasuries of between $65 billion and $85 billion

- Forward guidance should be enhanced to reaffirm commitment to keep rates low

From the expectations above, it shows that the market is expecting the Fed to dial back some of its earlier commitments i.e. daily asset purchases as they are no longer necessary, considering that market conditions are well maintained for now.

But the Fed should still reaffirm its commitment to do everything it can to ensure the economic recovery is not threatened, and a shift to monthly purchases should not be too big of a deal in that regard (they still own the flexibility).

If anything else, I wouldn't expect the Fed to "hard commit" to any yield curve control talk as well because it may lead to a situation of a taper tantrum within a taper tantrum should they start to walk back on the current set of policy measures in the future.

As long as the market isn't running away too far, too fast then they should not see much to firmly commit to such a move just yet. But as we saw towards the end of last week, things can get tricky really quickly so there's that to consider.

If anything else, they will still maintain their pledge to do "whatever it takes" and likely not play up the resilience and pace of the economic recovery. In essence, that reaffirms the continuation of their policy measures and should likely keep the party going.

In that sense, I would argue that the Fed would err on the side of caution so as to not dampen the recent euphoria in the market.

That should bode well for equities and not so much for the dollar, though one must also consider the possibility for some form of correction after the unrelenting move higher (lower) in the past two weeks or so for stocks (dollar).