ANZ revision comes after the RBNZ statement yesterday that drove the kiwi much lower

ANZ (in brIef)

- RBNZ … still a long way away from tightening (and perhaps could even ease further)

- has shone a brighter light on the shift in New Zealand's yield structure relative to the rest of world

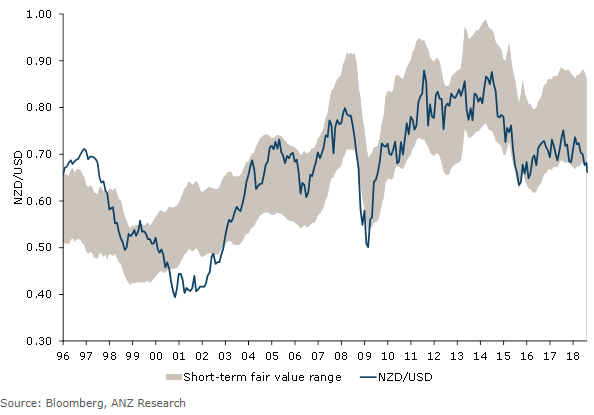

- NZD at around 0.66 is now below the bottom end of our short-term fair value estimate range, we think this yield structure story increases the odds of an undershoot and likely outweighs any lingering positivity from elevated commodity prices

NZD/USD forecasts to 0.62 (from 0.67) and see it at 0.61 over 2019.

- If growth continues to deteriorate and the market begins to embrace greater odds of a rate cut, the NZD/USD will be pressured even more.

- This takes our end-2018 and end-2019 forecasts for AUD/NZD (NZD/AUD) to 1.13 (0.89) and 1.15 (0.87) respectively.

(bolding mine)