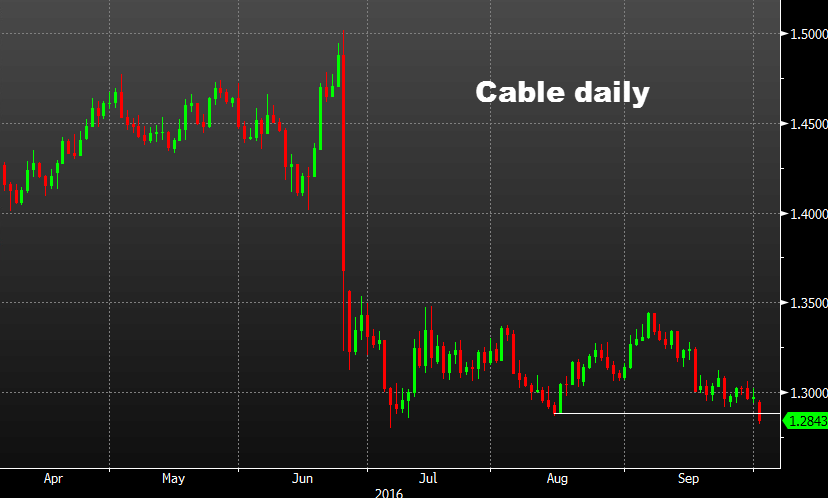

The latest 'FX Insight' from ANZ focuses on the Brexit woes of sterling and set targets on the downside for the pound.

In (very, very) brief (and bolding mine):

- Tone of PM May's speech played into the idea of a hard Brexit

- FX market is dealing with trying to guesstimate an appropriate level of risk premium for holding sterling

- PPP estimates, sterling is anywhere between 5% and 25% undervalued vs USD

- Spot is some 22% below its long run average for the past 25 years

- On both criteria, it is probably fair to conclude that sterling is cheap

- BoP deficit implies that there will be ongoing background selling of sterling

- Brexit uncertainty means those who may be planning on investing in the UK for access to the European single market will remain cautious

- The Bank of England does not seem in anyway alarmed at the sterling's slide

- Weakness, if anything, is helpful in returning inflation toward target

- Supporting growth via the export channel and import substitution

- Our bias therefore is to remain short sterling. Whilst historic valuation metrics suggest it may be cheap, the lack of clarity over the UK's future economic framework is leaving the market struggling to find an appropriate risk premium. The sizeable funding gap is a weight on sterling while low interest rates and forward guidance favour portfolio diversification. Additionally, from a growth perspective the preference seems to be for a weaker sterling.

Targets:

- In the coming months, we anticipate the pound will fall into a 1.20-1.25 range vs USD as uncertainty and a large c/a deficit (5.9% of GDP)weigh on sterling.

-

As Adam posted earlier ... cable at 30 year lows ...