ANZ (in my briefsummary) for the most recent data (released Friday)

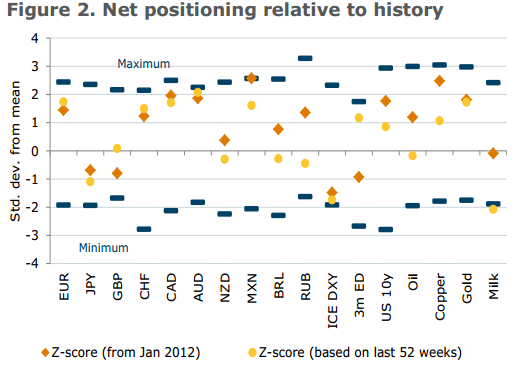

Leveraged funds turned net USD buyers for the week ending 5 September, despite weak dollar price action

- Funds reduced their net short USD positions by USD1.4bn to USD6.5bn, the lowest net shorts in three weeks

- However, short USD positions could have been rebuilt since then as USD has tumbled further, amid uncertainty over the Fed's rate hike path, news of approaching Hurricane Irma and continued geopolitical risks over the Korean Peninsula

Dollar buying for the week was broad based except against the CHF

All other major currencies saw net selling, led by the pound and the yen

EUR saw small selling ahead of ECB meeting on 7 September

- However, price action post ECB meeting suggests a rebuild of long EUR positions.

Commodity currencies were also on the back foot during the week with net selling of USD0.5bn

- After net buying for 12 consecutive weeks, AUD saw marginal selling of USD0.02bn

- Long NZD positions were pared for a fifth consecutive week

- CAD also saw a reduction of net longs ... but strong price action after BoC's rate hike on 6 September points to a re-build of long CAD positions

Net long gold contracts rose to the highest since September 2016

net long crude contracts also rose after four weeks of net selling

net longs in 10-year USTs fell after two straight weeks of buying even as yields moved lower

--

ANZ look at the US Commodity Futures Trading Commission (CFTC) a little differently to elsewhere. In a brutally summarised description of how they use it (any errors are mine):

- There are two reports compiled by the CFTC: the Commitment of Traders (COT) and the Traders in Financial Futures (TFF)

- The TFF report provides a richer breakdown of traders into the 'sell side' and 'buy side'

- ANZ use the parts of the TFF report (combined futures and options position of Leveraged Funds) as a proxy for leveraged positioning, where available