Says ANZ o their China outlook:

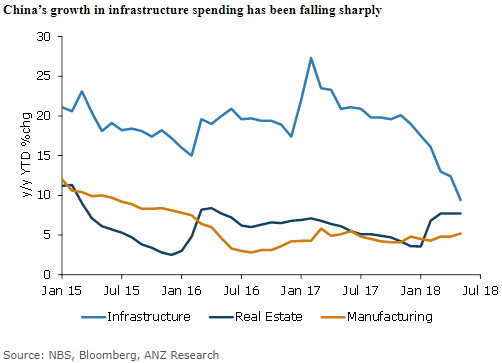

We believe China will take a more proactive stance to support economic growth in the H2 2018

- State Council may launch some growth boosting measures, which should help turn around weakening growth in infrastructure spending

- We see this ultimately supporting steel and iron ore market, with the later likely to push back towards USD70/tonne

- A recent State Council meeting called for an acceleration in fiscal spending, which may help to provide funding for infrastructure projects

Bolding mine. Higher iron ore prices will act as a support for AUD (Australia sends lots of the rock to China)

---

You will have just seen the CNY mid rate setting:

China is already taking action to support the economy , CNY devaluation will help support exporters.