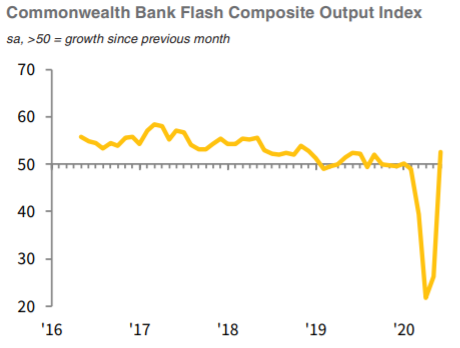

Huge improvement for the services flash PMI

Australia CBA / Markit preliminary PMIs for June

Manufacturing comes in at 49.8 from prior 44.0

Services 53.2, prior 26.9

Composite 52.6, prior 28.1

An encouraging set of results, detail from the report below. AUD barely moved.

Manufacturing

- manufacturing sector neared stabilisation in June, with much softer reductions in output, new orders and exports recorded.

- The rate of decline in employment remained sharp, however, as firms operated below capacity.

- Considerable disruption to supply chains remained, while the rate of input cost inflation quickened to the sharpest since May 2018.

- Selling prices were raised, following a fall in May.

- Confidence regarding the 12-month outlook improved to a 16-month high, with firms predicting a return to normality over the coming year

Services:

- returned to growth in June as the easing of COVID-19 restrictions led operations to resume and customer numbers to improve

- New business also rose, albeit marginally amid the ongoing impact of the pandemic.

- Employment decreased for the fifth month running, but the rate of job cuts was the weakest in this sequence.

- Meanwhile, both input costs and output prices rose for the first time in three months

CBA comments on the results:

- "The June PMIs are consistent with our view that we are now past the low point in economic activity. Overall conditions are still very soft, but there were a few encouraging pieces of information in the PMIs."

- "Confidence has improved in both the manufacturing and services sectors. And the lift in both input and output prices is welcome as it suggests we are more likely to be in a period of disinflation rather than deflation. The further decline in employment was disappointing, but given the lagging relationship between employment and output it is not surprising. We should see headcount lift from here."