Expectations are centred on another strong gain for jobs:

- Employment Change expected +20.0K, prior +16.0K

- Unemployment Rate expected 5.5%, prior 5.5%

- Full Time Employment Change prior was -49.8K

- Part Time Employment Change prior was +65.9K

- Participation Rate expected is 65.6%, prior was 65.6%

A few of the bank previews:

ANZ:

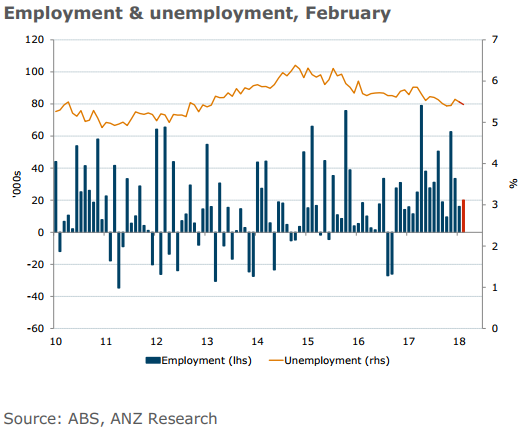

- We expect another solid rise in employment for February, extending the record run of monthly gains.

- The fundamentals remain sound; and leading indicators, in particular the profits and employment readings from the business surveys, suggest ongoing jobs growth.

- We look for a rise of 20,000 and a tick down in the unemployment rate to 5.4%.

CBA:

- Employment rose by 16.0k in January following a 33.5k lift in December. And the unemployment rate moved a touch lower thanks to a fall in the participation rate.

- Leading indicators are consistent with robust employment growth over coming months. As such, we have pencilled in a lift in jobs of 20k over the month for the unemployment rate to hold at 5.5%.

- Sample rotation means that the odds are skewed towards the participation rate nudging up a touch.

TD:

- We do not look for a blockbuster Feb report, seasonals of recent years hinting at a modest addition of up to 15k at most.

- We look for an addition of 12.5k jobs, keeping annual employment growth just above 3%. An unchanged participation rate of 65.6% leaves the unemployment rate at 5.5%, a half-percent above full employment, as the RBA likes to regularly remind the markets.