The latest bi-annual FX survey from the Bank of England

Daily FX volumes $2.2tn as of April 2016

Spot turnover -21% y/y yo $755bn per day

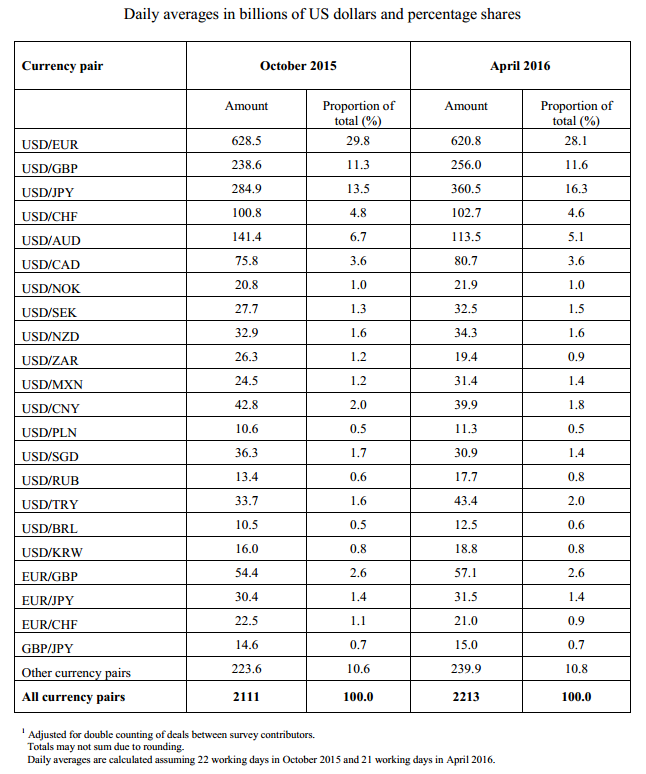

Daily volumes were -9.0% y/y but up 5% since October. the rise was led by USDJPY which increased by 27% to $361bn per day. No surprise that dollar yen was so active what with the expected, and then actual Fed hike late last year.

From the survey;

Most products saw a relatively small increase in turnover over the 6 months to April 2016

but remained below April 2015 levels. FX spot turnover rose 4% to $755 billion per day,

but remained 21% lower on the year. FX swap turnover rose compared to 6 months

(+4%) and a year earlier (+2%), but remained below the record survey high set in April

2014.Turnover in most currency pairs rose, with strong relative gains in some EM currency

pairs including USD/TRY and USD/MXN. GBP/USD turnover rose 7%, to $256 billion

per day. In contrast, there was a 20% decrease in USD/AUD turnover (lowest since

October 2010), and a 7% fall in USD/CNY turnover (lowest since October 2014).

Due to the OTC nature of FX markets, this is about as close as we get to seeing what the real volumes are.