The oil market is about to liven up after Saudi Arabia more or less ruled out production cuts and said they would be happy with even further drops in the price. Eamonn had the story from Reuters early this morning and it’s big news if true.

Anytime oil drops below the $100 mark it becomes painful for producers as the margins get eaten up fairly quickly. While it brings short term pain to producers the Saudi’s are looking at the long game. The US are sitting on an abundance of oil and added with the shale revolution they are getting themselves into a very strong position to become one of the biggest oil producers. If they actually opened up the door to exports then the global oil picture will change massively.

As Reuters point out in the article, if the Saudi’s do allow the price to continue to fall it’s going to be a one way street down and that will make it less attractive to new producers and shale projects that need the higher selling price to break even, let alone profit. Shale production is very expensive so if the Saudi’s want to protect what they’ve got they effectively have to push others out of the price bracket.

It’s going to make for an interesting few months ahead and aside from the economic benefits to heavy energy importers it’s going to be a good fight to watch as other producers will need to start cutting production and costs to keep themselves in the game.

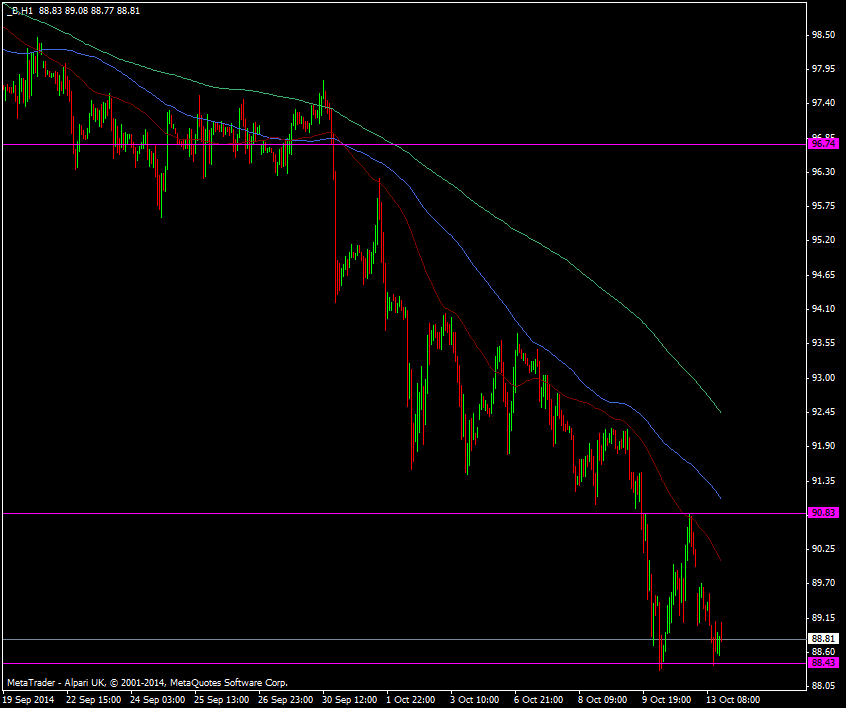

So what for the price for oil? It’s still early days in hearing about this Saudi strategy and we are also in a bearish trend due to oversupply and lack of demand. We’re still managing to hold the June 2012 lows in Brent but the bounces are very weak.

Brent crude oil h1 chart 13 10 2014

I showed the weekly picture last week and the risks still stand that if the level breaks here at 88.30/40 and 88, then we’re heading for 80’s or worse in quick time. Fade big bounces and go with the break is the way to play it.