Highlights of the Canadian inflation report for September 2015

Core CPI y/y

- Prior was +1.3% y/y

- CPI -0.2% non-seasonally adjusted m/m vs -0.1% exp

- Core CPI 2.1% y/y vs 2.2% exp

- Core CPI +0.2% m/m vs +0.3% exp

- BOC core +0.2% vs +0.3% exp

- Full report

Another reason to sell the Canadian dollar this week. It compounds yesterday's retail sales report and the BOC's dovish talk a day earlier.

China is the driving force in markets at the moment but this gives the Bank of Canada another reason to cut in December. There is much data to digest before the decision and the PBOC is the main factor today so the loonie probably gets a stay of execution for now.

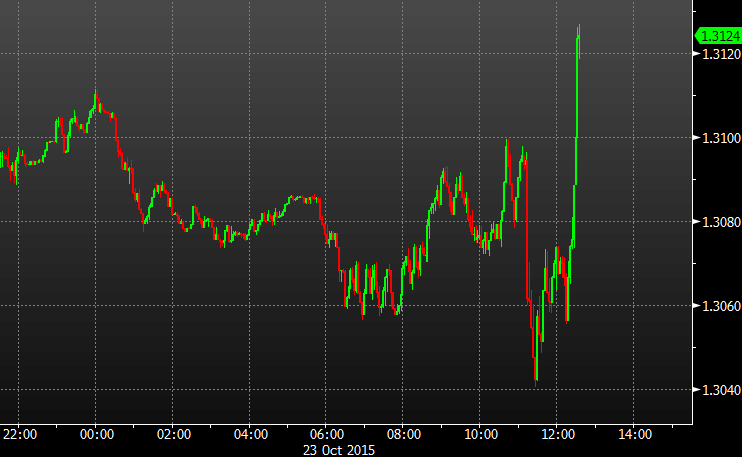

USD/CAD is up 16 pips to 1.3104 on the day from 1.3075 before the data.

Details:

- Prices for food purchased from stores were up 3.9% year over year in September

- Vegetable prices up 11.5% y/y

- The clothing and footwear index was up 1.2%

- recreation, education and reading increased 2.5%

- Transportation index declined 3.5%

- Shelter +1.1% y/y

Looks like all my skipping vegetables paid off.