China's Q4 2015 GDP release could end market's haywire by easing or increase slowdown fears

It's a biggie for China tonight as we get their latest GDP numbers. Markets seem pretty unaffected by the upcoming numbers but that could change as we head towards the release.

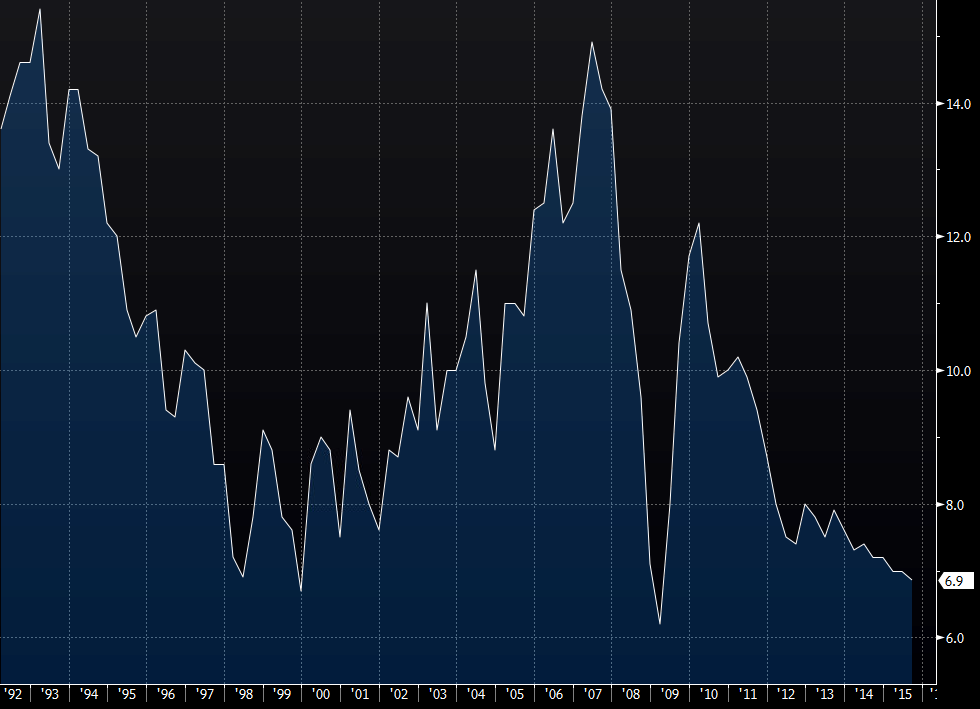

Expectations are for an unchanged 6.9% for Q4 y/y and unchanged 1.8% q/q

Chinese GDP

Most of the market is leaning towards a worse number so one risk is that's it's better than expected. The other is that it's much worse. My usual gauge is to give numbers like this 2 percentage points on either side. Inside of that, markets generally don't do much, outside of that we get a bigger and possibly longer lasting reaction.

With China we also have the trust issue. If they print something over 7.0% there will be a lot of eyebrows raised about the authenticity of the data. If the market believes it's made up rubbish then any gains are going to quickly evaporate. That will come in the days after as the info is sifted through.

Commodity currencies are most at risk from the numbers later. AUD and NZD among the most likely to see some action, as will commodities themselves. While they might be quiet now, they could just be waiting for this data before busting a big move. Don't be lulled into a false sense of security.

This will be a big test of the current fears surrounding China. If anything it will shed some light on how deep those fears are. If we do see a marked drop in GDP then we could have some real fun and games when Europe, and then the US, open tomorrow

How do we play tonight?

I'll be tucked up with teddy when it happens so I'll pick up from whatever debris is left in the morning. If you're in trades that can be materially affected by the data it might be wise to make sure you have a grip on the position and your risk.

Alongside the GDP there's also industrial production and retail sales. Eamonn has a great preview of what to expect from all the numbers.