From Deutsche Bank’s ‘FX Blueprint’ ….

—

Our view is – in the wake of the significant repricing of AUD/USD over the past few weeks – neutral through year-end.

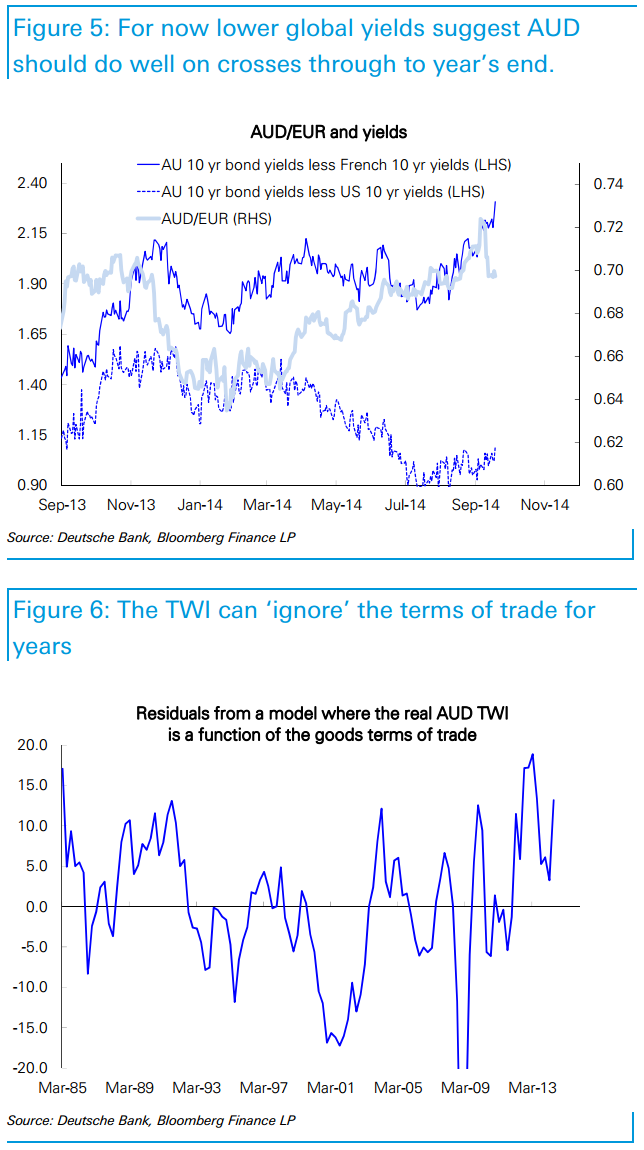

But we see scope for AUD outperformance against the low-yielders, buy AUD versus JPY and EUR:

- Carry trumping commodities for now While terms of trade may be the major long-run driver of the Aussie’s TWI, AUD can and does deviate for long periods. Indeed the ‘over-shoot’ of the late 1980s and the ‘under-shoot’ of the late 1990s / early 2000s both lasted around 4 years. So far the real AUD TWI has only been over-shooting the terms of trade for the past 2 years. We should therefore not be surprised if deviations from a ToT ‘fair-value’ estimate were to persist for another two years. Put simply, carry can trump commodity prices for a little while longer.

In our view the Fed – and the US bond market – are more important drivers of the AUD than iron ore. The price action in AUD/USD – especially last week – appears to have provided some support to that view. Namely, after having been largely resilient in the face of both weaker iron ore prices and also a stronger USD, it was the sell-off in US yields ahead of the 16-17 September FOMC meeting that finally pushed AUD/USD lower. The ‘dominance’ of US yields over AUD/USD has been a consistent theme since mid 2012 – which is when the Australian rates market priced a 2.50% RBA cash rate. This suggests that a stronger USD driven by lower European yields (as was the case over much of August) is ambiguous for the Aussie