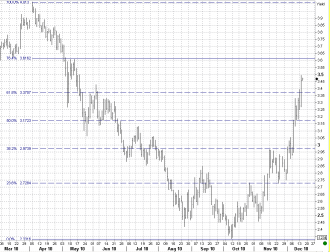

3.494% is the highest I’ve seen yet..

Not exactly sure what new news the market is reacting to, but sometimes trends just extend, once news events are out of the way. The Fed said nothing new, but it looks as though the market has come to the conclusion that loose monetary plus loose fiscal policy plus lousy technicals for the bond market equal much higher rates…

Much higher rates are working to the dollars benefit today but could be a detriment tomorrow if traders see the rate spike as a lose of confidence in the Fed/Treasury…At the moment, I’d put down about 25% of the move to loss of confidence, 25% to improved economic prospects and 25% to a further rise in the deficit based on the passage of the latest tax cut/stimulus package and 25% to technicals.