If anyone was hanging out for Draghi to utter some words of inspiration in how to turn the European slump around then they’re still waiting.

It’s doom and gloom in Europe and no amount of sugar coating will fix that view. Some countries are getting what they wished for in a weaker currency but there are little signs that they have the wherewithal to make use of it. Of course we can’t expect a miracle from a 1000+ pip drop in a mere 4 months but Europe is going to need to see some signs of improvement early in the new year or the market may start fearing the worst again.

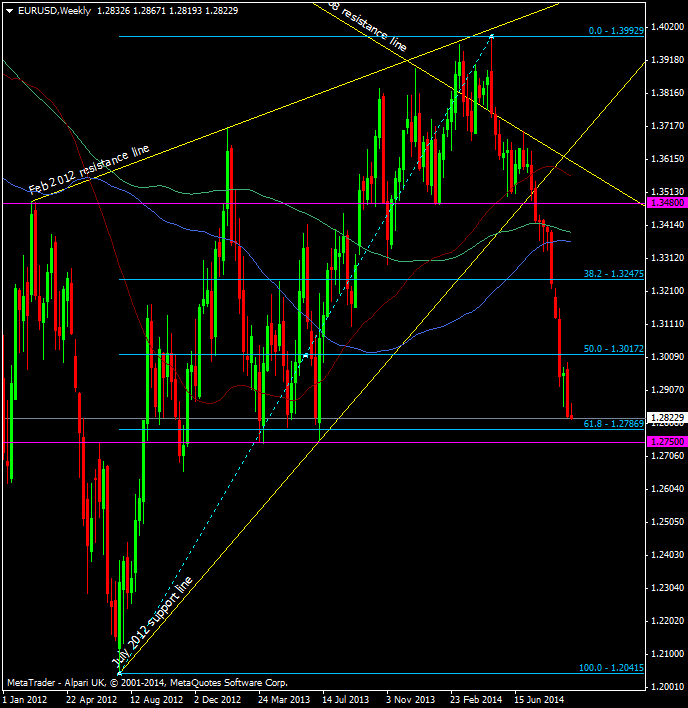

And so the euro continues to track lower and we’re approaching a big couple of levels that I’ve been highlighting for a while.

EUR/USD Weekly chart 22 09 2014

The fib and double bottom (there’s a good case to plug a triple bottom) are they types of levels I’d look to see a big bounce from but I like to have some positive fundamentals in the back pocket too before thinking about a long term trade. At the moment the positives are scarce and the negatives are abundant. That tells me that while I like the level for a long, I’m going to keep it fairly tight and focused for a short term return rather than building a long term position.

I’ll probably look to buy just ahead of 1.28 or the fib, then 1.2750 with a stop just below the Nov 2012 lows.