This via TD with their outlook for G1- FX over coming months (into H2) - this on euro (bolding mine)

- The EUR rallied in 2017 amid solid growth and inflation metrics slowly returning to target. Against this backdrop, the EUR has been at the forefront of the convergence trade. With a gain of 14.1% vs USD in 2017, the EUR was the best-performing G10 currency.

- However, we turned tactically bearish EUR in early Q2 as a correction appeared due. We retained our strategically bullish EUR outlook however. We have held this stance since early/mid-2017 as the currency's fundamentals have steadily improved.

- We are reverting to a more neutral/bullish footing. We think the EUR's latest correction will reverse as the macro dynamics supporting its appreciation are both powerful and durable.

- The region's growth performance has come back to Earth but it remains at a solid pace. Recent data point to continued expansion even though the region sharply underperformed (wildly inflated) expectations in Q1.

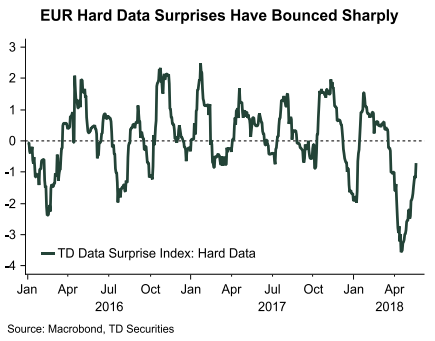

- TD's Data Surprise measure has bounced aggressively off of its lows - particularly for "hard" data. The equivalent Citibank measure has lagged these developments but is also showing signs of an upturn.

- Weak "underlying" inflation remains a persistent concern for the ECB despite an extended period of above-trend growth. Some alternative measures to core HICP suggest a more sustained increase in price pressures but progress has been slow.

- This could leaves the ECB on a somewhat cautious footing, tempering our near-term bullish outlook. TD macro expects a 6m taper announcement in July The first depo rate hike (15bps) in Sept 2019, followed by a hike to all three policy rates in Dec 2019. From there, we expect two rate hikes/year from 2020. We think they will continue to try to dampen market enthusiasm for EUR gains if they become too rapid. The pace matters more than the level.

- Still, we think the EUR's longer-term prospects are quite bright. The EUR enjoys solid support from its external balance position. Capital flows are turning more constructive as global investors return to European financial markets. The EUR is a natural beneficiary of ongoing political turmoil in the US.

- Capital inflows that result from reduced ECB bond-buying, Reserve Manager accumulation, and asset allocation shifts out of USD-denominated assets will contribute to longer-term EUR appreciation. Looking forward, we do not think the Q4 COFER data 'disappointment' will be particularly meaningful in the broader context.

---